Gartner Magic Quadrant for ECM 2012: What to expect?

[note color=”#cfcfcf”]This article is an opinion piece contributed by Hemant Prasad. You can visit him on his blog, http://ecmwise.blogspot.com[/note]

Gartner released 2012 Magic Quadrant for Web Content Management (WCM) sometime back and the next in line will be MQ for ECM. While the WCM player's positioning remains pretty much the same compare to 2011 report, it was quite surprising to see a sudden drop in the rating of Autonomy after being acquired by HP. Gartner has dropped its rating both in terms of ability to execute and in vision, primarily due to the uncertainty over HP's commitments and business plan for Autonomy.

Though there was no surprise to miss the name of one of the ECM leader, EMC from the WCM Magic Quadrant. The curiosity however grew over EMC's strategy for adding this missing piece in their ECM offerings. Now I'll be eagerly waiting to see the 2012 Magic Quadrant for ECM which is expected to be delivered by Gartner in Q4, hopefully in October itself and see how will the EMC's absence from WCM arena affect their position in ECM MQ.

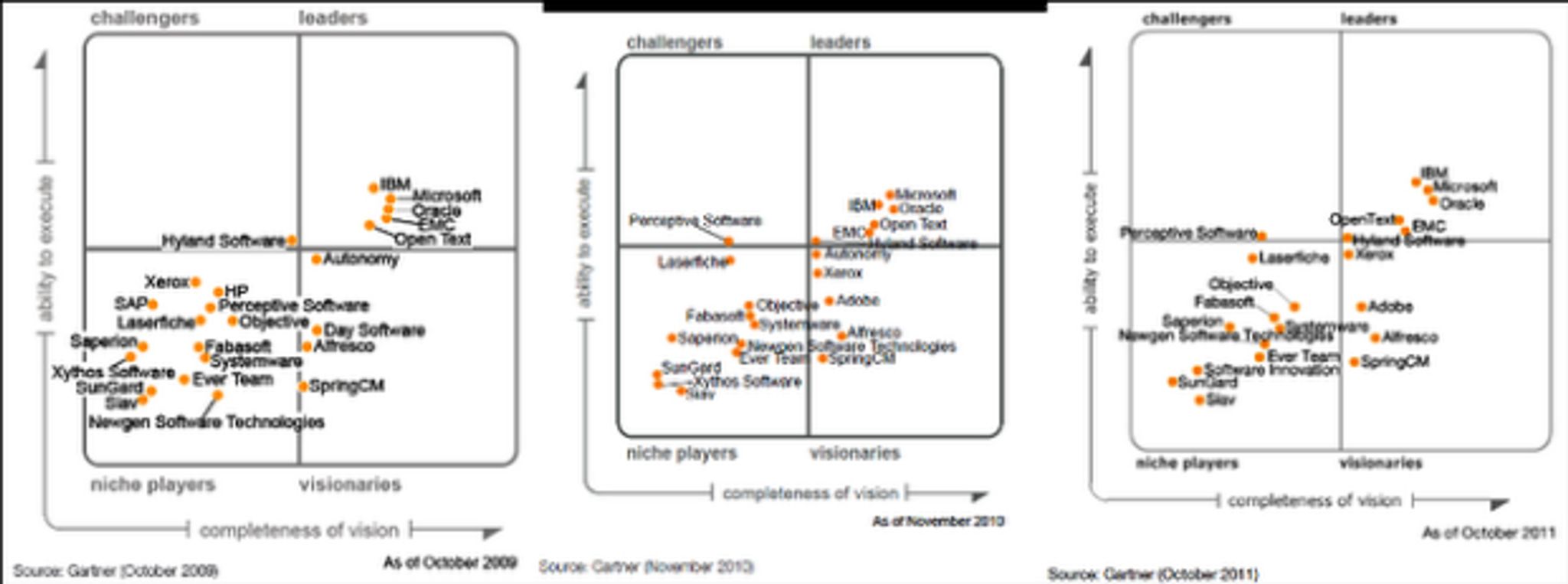

A quick comparison of various players in Gartner Magic Quadrant for ECM 2009, 2010 and 2011 shows the following trends:

|

|

Ability to execute |

Visionaries |

|

2009 |

IBM led the race in this area, followed by Microsoft, Oracle and EMC. EMC was at No. 4 and OpenText at No. 5 |

Microsoft was the visionary leader, which reflected in its ability to execute in 2010 report. Followers were Oracle, EMC IBM and OpenText. |

|

2010 |

Microsoft pushed IBM down claiming the top spot followed by Oracle. EMC lost 4th spot to OpenText and got pushed to below OpenText. |

Oracle led the race leaving behind Microsoft, IBM, OpenText and EMC. EMC was not only lacking in ability to execute, but also in vision behind OpenText. |

|

2011 |

IBM gained top spot back and the positioning was similar to 2009, except that EMC was performing below OpenText now. |

Oracle led the race leaving behind Microsoft, IBM, EMC and OpenText. EMC was seen to be giving positive signals in terms of their ECM vision. |

|

2012 (My predictions) |

IBM should still make it to top with its clear product strategy and overall viability. The positioning is not expected to change since 2011. |

Microsoft should gain the top spot due to the recently announced SharePoint 2013, followed by Oracle, IBM, EMC and OpenText. |

So what do you think is wrong with the once market leader Documentum? Where has EMC gone wrong in its overall ECM strategy? Or is it just that the sluggish license sales is pulling them towards ‘fancy' solutions like D2? which might help them acquire more new customers with the sales pitch of ‘new user', since Webtop was perceived as a very complex user interface with the arrival of SharePoint.

In ECM MQ 2011, Gartner had highlighted the (1) Lack of synergies with its hardware and services team (2) Lack of SI and ISV ecosystem (3) Confusion over its product strategy in Social collaboration and WCM space as the key caution points for EMC.

In 2012, the challenges seems to have not gone away. EMC still doesn't have a Social Collaboration and WCM solution and future for eRoom or CenterStage remains uncertain. With the arrival of D2, it's certain that EMC will not invest into Webtop and TaskSpace anymore, which might scare the customers who have been using either of these applications since long and have built critical business applications using either WebTop or Taskspace. While EMC has been proposing D2 for content applications, xCP is being promoted for the case management/business process applications. There doesn't seem to be an automated migration path to convert Webtop/Taskspace based applications to D2/xCP 2.0 and customers might have to spend hefty sum to redevelop the same on newer platforms, which will be a painful exercise and might drive customers towards alternate solutions.

Though EMC has made lots of noise about “ECM in cloud” partly relying on their cloud storage business, but the successful roll-out of the service is yet to take shape, wherein Microsoft has already left their rival behind with the successful operation of Office365 in cloud (including SharePoint).

OpenText on the other hand seems to be enjoying relationship with SAP with few small wins in recent past primarily in the area of SAP content archival (that's the only product OpenText sales team seems to be selling), but still lacks larger customer acquisitions, which isn't a sustainable business strategy, unless they have already got into the comfort zone of eventually being acquired by SAP in due course of time. While the OpenText corporate seems to be on an acquisition spree with recent acquisition of EasyLink, the sales seems to be enjoying honeymoon with SAP.

Oracle made a daring announcement in Oct 2011 to swap Documentum platform licences for free. It reflected Oracle's desperation to get a few customers on their side quickly and set a precedent of acquiring rival's customers. The offer was shot down by analysts soon after the announcement, who proved that the clever math of Oracle was nothing but a marketing gimmick and customer didn't really have anything in the offer to be excited about. I haven't also heard if any customer picked-up the Oracle's offer till date. The outlook for Oracle hasn't changed much since then and they still seems to be spending lots of time in just renaming the product again and again (from Stellent to UCM to Webcenter now). Though I have heard few sizeable customer acquisitions by Oracle in recent past, but they have a long way to go in positioning their solution right against the well-established players like IBM, EMC and Microsoft.

IBM has its usual problem, a behemoth which has many dishes in its kitchen and is really confusing customers with the choices it can offer on ECM. It has IBM Content Manager, the Lotus suite and the FileNet ECM, so the sales folks seems to be often giving more than the required choices to customers or competing within. While analysts have rated FileNet BPM better than the rival's case management platforms, its facing competition within, by the Lombardi or Websphere BPM sales folks. Moreover in my experience, IBM is not known for doing justice with software acquisitions and we have a disappointing history of Lotus and Rational acquisitions, which have been fast losing market attention, though being the market leaders in their segment at the time of acquisitions.