Pulp fiction payday? Here’s why Squarespace is trading public life for a juicy private deal

"You can get a steak here, daddy-o. Don’t be a [square]." Maybe it wasn't "Le Royale Cheese" on the stock market, but the website builder could be in a better position as a private player.

I was recently in Paris, where, along with the Eiffel Tower and a metric tonne of boulangeries, there are 76 McDonald’s restaurants.

That might seem like a decent concentration for a single city, but consider that the entire country of France is home to 1,560 MickyD outlets. That makes it the largest European market for the fast-food chain – and a true testament to French frites.

The last time I passed the Golden Arches in Europe, I was in the city of Bath in rural England, desperate for coffee. I’m not a fan of the food (well, maybe the McMuffin is OK), so I don’t remember perusing the menu. I do remember that the joint was a stone’s throw from ancient Roman ruins, making it a weird confluence of epic imperialism.

A few weeks ago, my wife and I were perusing the storied steps of the Champs-Elysées during a record-setting picnic event. 4,000 people had lunch on the avenue, squatting on the world’s largest checkered tablecloth that stretched 216 meters from the Arc de Triomphe. And right there, along the world’s most famous street plush with exquisite architecture, is a McDonald’s.

You might not recognize it at first: the arches are white, not golden, a concession the company was forced to make when setting up shop in 1972. But there it is.

We felt compelled to stop in, not just to behold the spectacle, but because someone told us their macaroons (yes, they have macaroons) were actually decent. Was that possible?

We ended up foregoing such a risky dessert decision, but I was curious about another menu item: Le Royale Cheese. The name was made famous by the 1994 film Pulp Fiction, in which John Travolta’s character explained how the metric system rendered the Quarter Pounder – the signature staple at every McDonald’s in the U.S. – incompatible.

Tragically, Le Royale was retired in 2019, leaving public life behind. Disappointing? Sure. But hey, sometimes things don’t work out the way you think they will.

One might say the same of Squarespace, the protean website builder and hosting platform founded by Anthony Casalena in 2003. According to lore, he built the company in his dorm room at the University of Maryland and is still leading the charge.

Like McDonald’s, Squarespace is an almost ubiquitous brand, democratizing website design to the mainstream and benefitting from the reach of Superbowl ads and other visible media. Millions have been served, and billions earned.

With Squarespace, you get the feeling that anyone can build a website. And like the Golden Arches, it’s earned a kind of rapid, self-service reputation that allows entrepreneurs and small shops to create their personal or business brand online with no code or development skills.

In this beginner-friendly, “all-in-one” monolith market of digital experience tools, Squarespace has been a pioneer. As Casalena explained in 2014, he was originally challenged by a lack of solutions that abstracted code and complexity from users like him.

“None of the products out there took style or design into account, which doesn’t work when you’re trying to build your personal identity online,” he said. “Your website is where your ideas live. It reflects who you are. And all there was out there were these geeky, bargain-bin sort of services charging $2.99 a month for clunky experiences. So when I started Squarespace, I just wanted to make a site for myself. I never thought it would be a business.”

But mon Dieu, it has become one – and its peers have capitalized on this opportunity as well, moving laterally (like Wix) or upstream towards complexity (think Webflow or Duda). There’s also a plethora of basic, ride-along tools that live inside marketing platforms like GoDaddy and Constant Contact.

As such, the all-in-one builder has become a competitive crease in the market's folds, and Squarespace has long led the charge with some spectacular innovations. This has graduated the platform to attract larger organizations and agency cohorts to the mix. This is no surprise: since its inception, the company has tried to remain true to its core while flexing to be something more.

And more it has become. The tools are incredibly robust, with libraries of pre-built templates for making sites in a snap. Its Fluid Engine drag-and-drop editor provides unprecedented control over the responsive visual experience. There are some fantastic AI tools on both the design and content generation sides of the ledger.

Squarespace also sports its own content management system, enabling users to create and publish pages. They can also register domains, add e-commerce to sell products, access marketing and analytics, and more.

“Your website is where your ideas live. It reflects who you are. And all there was out there were these geeky, bargain-bin sort of services charging $2.99 a month for clunky experiences. So when I started Squarespace, I just wanted to make a site for myself. I never thought it would be a business.”

As of this June, Squarespace boasted almost 5 million subscribers, generating $1.12 billion in revenue.

And who exactly are these users? Everyone. Students. Hobbyists. Graphic and web designers. SOHO businesses. Digital agencies with lots of customers. Even major retail brands like Colgate are running workloads on Squarespace Enterprise.

Profitable. Desirable. On its way up. It all sounds like Le Royale Cheese – and precisely why the company opted to go public in 2021. It danced past offers from Getty Images to buy, instead raising a $38.5 million seed round that greased the wheels for a much larger valuation.

When it debuted on the NYSE, it clocked in at $6.6 billion, popping at a bit above $50 per share at its height.

And then, the bubble burst. Sort of.

After three years of fighting to perform on the public pedestal, the company announced last month that it would go private in a $6.9 billion all-cash transaction with Permira, a global PE firm with long arms.

So what happened? Why was the promise of Le Royale Cheese reduced to pulp fiction? And why wasn’t the steak as good as the sizzle? Well, there are several factors as you might guess. But if we go back to 2021, I think it’s pretty clear that it was always destined for challenges – and that trading public life for private is probably the best way forward.

Follow the money, honey bunny

According to The Information’s recent M&A report by Cory Weinberg, this private equity deal with Permira ends Squarespace's choppy, incongruous, and generally “unhappy” three-year dalliance as a publicly listed company.

As I’ll cover in a minute, they weren’t alone. Many tech firms went public during the effervescence of the COVID lockdowns, when digital transformation was careening at its most aggressive pace.

Like so many of those players (for example, Qualtrics) Squarespace’s IPO was a bust, a firework that failed to fully explode. They entered the dance floor at $50, but failed to climb above that for very long – and spent most of their time treading below it. In fact, Permira is paying $44 a share, which is almost 30% higher than the stock was trading last month.

Odds are, we can expect more of these SaaS-a-frass buyouts, which present stockholders with a kind of financial life ring. Often, CEOs remain in place, receiving a healthy buyout from the transaction while getting to “reboot” without the yoke of the Street choking their decisions (let's be clear… there's still a board and investors to please).

While the market still seems unsettled, 2024 has looked more promising than its immediate predecessors. Conditions were quite different in 2021, however. Irrational exuberance was injecting itself into the fray, and the market saw a record-breaking number of deals amounting to $5.9 trillion in activity.

As for IPOs, 2021 was the busiest year since 2000 for new issues. Along with Squarespace, more than 1,000 companies went public, with 396 traditional IPOs raising nearly $154 billion.

But fast-forward, and the tape tells a different tale. As of 2023, the biggest IPOs from the class of 2021 had shed 60% of their value. Squarespace wasn’t near the top – where tech darlings like Hashicorp and Gitlab had massive valuations – but they were part of a cohort that delivered, at best, mixed results.

What does this tell us? Simply put: the public winds were favorable, even if the ambitions outweighed the logic. Could they meet the expectations of investors? Was the addressable market large enough to reach the potential scale? At the end of the day, the dollar signs won out, buoyed by the market’s appetite for digital transformation.

Public friction created pulp fiction

With last year’s data still lingering, it’s not hugely surprising that investors aren’t more bullish about IPOs. Still, there are many unicorn-level private firms waiting out the storm, hoping conditions improve – and they seem to be. Will 2024 be a banner year? With an impending presidential election in the U.S., global conflicts, and persistent inflation, it’s not likely.

In the pivot back to private, Squarespace now has greater flexibility and resources to shape its next play. Odds are it will go back to its roots, doubling down on its mission to empower entrepreneurs to build better online brands and more easily transact with their customers.

Before you throw back another Le Royale Cheese, let’s be frank: for a specific tier of users, there are great benefits to building websites on a closed, proprietary system like Squarespace. The pros have already been delineated, but this transition brings with it many questions about what’s next for its 5 million customers – and how it might impact everything from costs to continuity.

First, several visible users have voiced concerns on YouTube, noting anxiety about the future. It’s clear that solopreneurs, agencies, and businesses with critical dependence on the platform are wondering how this transition might affect their own business models. Uncertainty can shake the foundation of trust and might send some creators to competitive platforms.

One thing is also certain: Squarespace spent a lot of time and money trying to meet the Street’s growth expectations. That meant adding bells and whistles to amplify growth on a preset trajectory. This saw the introduction of the aforementioned Fluid Engine, a beautiful product with real curb appeal that’s been plagued by issues since its launch.

Then there’s the M&A route. Before its IPO, the company bought Acuity Scheduling, and last year purchased Google’s domain assets (now called Squarespace Domains) for $180 million, which included roughly 10 million registered domain names and related customer accounts.

Squarespace already offered registrar services, but they were basic at best – and only a million or so customers using it. This was a clear move to up the ante, but people don’t always respond well to being handed off, and this might have chased some customers away. In fact, Automattic, the creators of WordPress, offered to cover the transfer and renewal of domains that migrated to its platform.

In the end, both acquisitions felt a bit like commodity plays and clearly didn’t convince investors that growth was in the cards.

In 2023, the company also introduced a new content-focused tool called Courses, enabling entrepreneurs to convert knowledge into courseware and monetize their expertise (think chefs selling cooking lessons and personal trainers pushing exercise regimens).

Admittedly, it's cool – and appeals to the DIY influencer inside many small businesses. The platform offers an alternative to other course-centric systems like Kajabi, which is hyper-focused on these kinds of capabilities. In that sense, it’s another “me too” product that might end up competing on commodity dynamics.

Is going private Le Royale Cheese?

As Squarespace embraces its new private position on the menu, there’s an opportunity to do what it has always done best: think ahead. By removing the straddle of the Street, perhaps it can refocus energy on its core business and take measures to reinforce loyalty.

One dent in the armor has been its Fluid Engine. The reception was rocky, and shoring up confidence is going to be key. Making this experience top-notch should be a strategic imperative, and continuing to engage and listen to users will help map the steps forward.

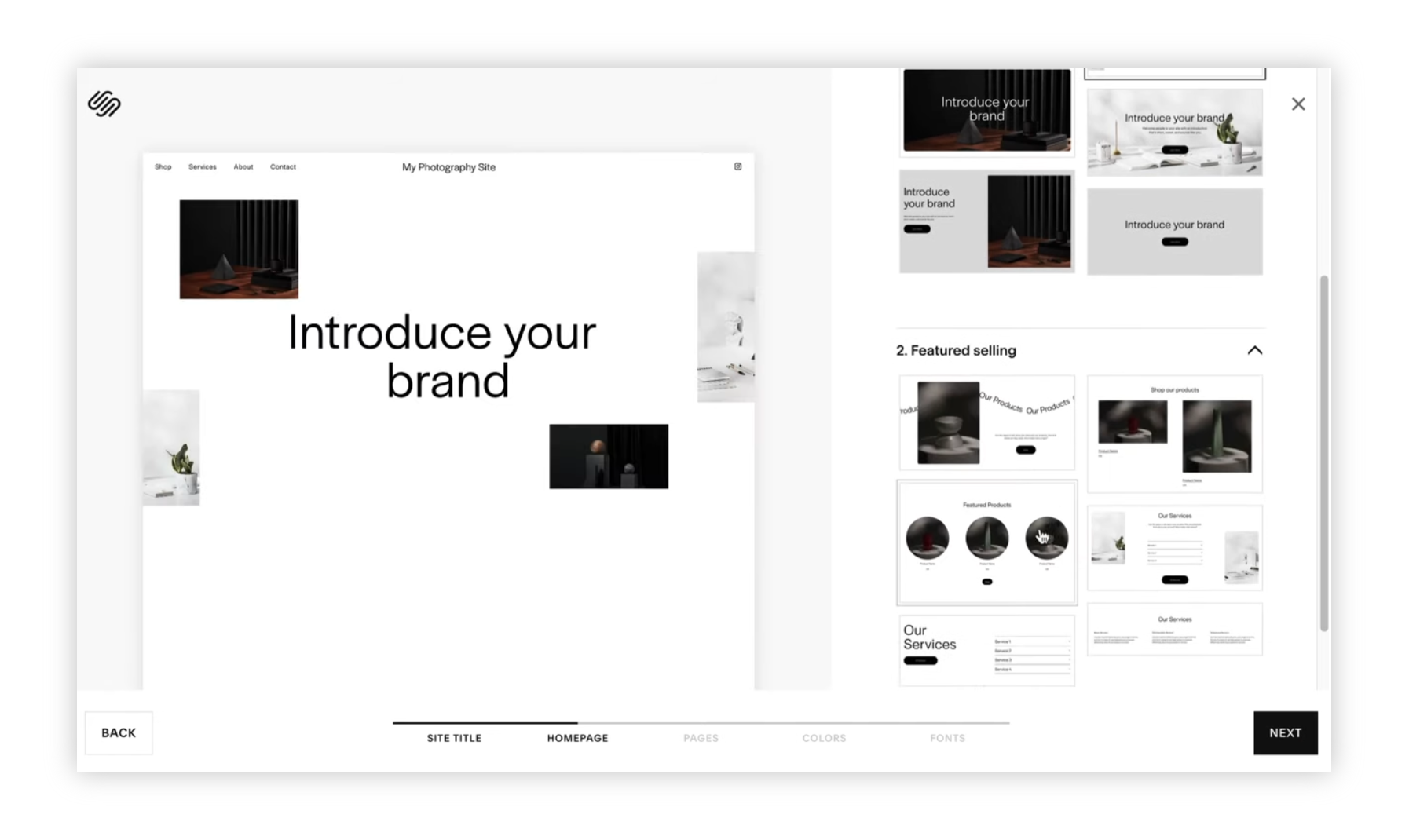

Competition is getting fierce, particularly as AI is entrenched in the field. That’s why improving more of its AI features, like Squarespace Blueprint AI, is key. This solution gives first-time users a guided system for designing, creating content, and even launching a website with less complexity. It leverages simple prompts to transform your answers and preferences into a custom, fully functioning website – and while it's not perfect, it's a major step in the right direction.

Squarespace Blueprint AI provides a series of prompts to automatically build a website

Competitive platforms like Wix offer similar features, but so do Web.com and Hostinger, which are wrapping it in with low-cost hosting plans. It's worth noting that Hostinger's current hosting plan, which includes its AI website builder, is priced at $2.99 – exactly the number Casalena referenced in 2014 as the “bargain bin.”

A lot has changed in a decade, and AI is transforming the game faster than ever.

Let’s be honest: the future of website design will, to some extent, be the domain of these automated tools. In that sense, AI may become “the great equalizer,” allowing other players across the market to tack on these enhancements.

At the end of the day, choice will drive down costs for consumers. It will also force the landscape of solutions to continue innovating – and that’s a net benefit to everyone. But increasing costs could have a chilling effect considering the optics of this recent transition. There's been some speculation on that, and I think it's a bad idea. Right now, ensuring confidence should be the top priority.

Squarespace is no spring poulette. As a 20-year veteran of the digital world, it’s in the rank and file of other long-tailed industry icons, which is both a blessing and a curse. As with many of its peers, being publicly traded was simply part of the track to success. But with tech companies, embracing the startup ethos can be an activator for innovation – and being a private entity could fortify the momentum.

Finally, as interest rates cool (hopefully) and conditions improve, tech companies will be on the prowl for acquisitions. Sure, they’ll be looking at hot properties like Gitlab, but websites are still an incredibly important channel in the martech ecosystem. I’m not sure I would consider Squarespace a target, but they might find other opportunities to enhance and enrich their offerings. So yes, M&A will likely play a role in their continued success, particularly if it's buoyed by greater freedom and control over their destiny.

Going private might not be the big, juicy answer for every tech company struggling with its publicly-traded persona.

But sometimes, it pays to be a square – and avoid the pulp fiction.

Upcoming conferences

CMS Connect 24

August 6-7, 2024 – Montreal, Canada

We are delighted to present our first annual summer edition of our prestigious international conference dedicated to the global content management community. Join us this August in Montreal, Canada, for a vendor-neutral conference focused on CMS. Tired of impersonal and overwhelming gatherings? Picture this event as a unique blend of masterclasses, insightful talks, interactive discussions, impactful learning sessions, and authentic networking opportunities.

CMS Kickoff 25

January 14-15, 2025 – Tampa Bay Area, Florida

Join us next January in the Tampa Bay area of Florida for the third annual CMS Kickoff – the industry's premier global event. Similar to a traditional kickoff, we reflect on recent trends and share stories from the frontlines. Additionally, we will delve into the current happenings and shed light on the future. Prepare for an unparalleled in-person CMS conference experience that will equip you to move things forward. This is an exclusive event – space is limited, so secure your tickets today.