MACH Alliance Publishes First Annual Report, Showcases Industry Impact and Plans for 2024

The report crystallizes the advocacy group’s efforts and innovations across the composable landscape in 2023, focusing on achievements and advancements while reinforcing its commitment to transparency.

For many large-scale organizations, an annual report is a moment of clarity. It encapsulates the past year’s performance with a keen focus on financials, and often provides a throat-clearing platform for the year ahead.

Sometimes, annual reports can be sobering. Historically, brands like Nike have used them as megaphones for change, staking the proper amount of accountability while shifting the narrative around less-than-stellar performance. In this sense, annual reports provide a reality check for investors while giving businesses a focused channel for communicating a vision for the future.

For the MACH Alliance – an advocacy group focused on future-proof, open, best-of-breed technology ecosystems – the publishing of its first-ever annual report is a bellwether moment. It signals an organizational and market maturity that further elevates its relevance while underscoring its responsibility to its members and the community at large.

Perhaps most importantly, this annual report is a testament to transparency. Since last year’s MACH Two Conference, I’ve spoken frequently with Casper Rasmussen, president of the Alliance – including a year-end interview that detailed some key predictions for 2024. In almost every conversation, he has emphasized the importance of transparency and detailed how the Alliance is committed to embracing a more open posture.

Why is this important? Because the organization has been challenged by vendors and industry watchers alike, protesting a lack of clarity around its certification processes. While not completely shrouded in secrecy, the Alliance has also struggled with an egalitarian mantle, being thrust to a level of market demagoguery by some analysts (we all know about that velvet rope).

There have also been challenges relative to the MACH moniker and defending the organization's IP (this was the subject of an open letter published last year). Still, the unshakeable truth is that the Alliance has managed to unite a good share of the market around a common vision while educating and evangelizing the value of composability.

Since its inception, the MACH Alliance has come a long way – and this annual report reflects that evolution. After reading it cover to cover, I’ve tried to encapsulate a few thoughts below on what stood out. That said, I recommend perusing it for yourself; it’s available and ungated at https://machalliance.org/annual-reports

Growth was a core theme in 2023

First and foremost, the growth of the MACH Alliance is undeniable. As Rasmussen states in his opening salvo, the adoption of MACH technologies has become a “linchpin for success” as businesses grapple with an ever-evolving digital ecosystem. Now boasting 100 members, its reach has clearly broadened – and as stated in a prominent statistic from its 2023 survey, 92% of tech leaders felt the work of the MACH Alliance has been valuable.

The Year-End Highlights section reinforces the Alliance’s achievements over the last 12 months, codified in customer use cases and celebrated at the MACH Two Impact Awards last June. It’s worth noting that 98% of delegates attending the MACH Two Conference rated it as “excellent” or “very good,” a stunning reflection of the quality and perceived value of the event.

There’s a quote from Gireesh Sahukar, VP Digital at Dawn Foods, in the report. To me, it reflects how deeply embedded the role of the Alliance has become: “It’s the first question we ask as part of our RFP. Are you a member of the MACH Alliance? Explain.”

To be sure, not all enterprises have woven this question into their assessment practices. However, it does illustrate a growing movement towards MACH as part of the buying journey, and how the Alliance is providing a layer of confidence around the decision-making.

The Governance section illustrates how the MACH Alliance has evolved its organizational practices around key teams and processes. While discrete councils for tech and marketing have been a part of the tapestry, the further evolution of “Taskforces” is designed to support key initiatives and defined outputs for objectives such as content, tools, or even MVPs.

It’s no surprise that one of the big concentrations is certification. As previously stated, the certification process has been a focus of criticism, but the increased communication with applicants around the challenges has certainly improved – with many rejections going through the submission process again with better outcomes. In fact, according to Rasmussen, 15% of members accepted in 2023 undertook a strategic transformation to achieve MACH certification.

2023 saw an expansion not only in the total number of members, but the available categories for admission. This includes the new Supporters segment, which offers a path for companies that are not ISV, SI, or Enablers but want to engage with the community (PayPal became the first member last year). This edging towards a more inclusive model is helping to reshape the membership footprint and expand the community at multiple levels.

Focus Areas provide context for the past and the future

The Focus Areas section of the report tightens the aperture around industry collaboration, open standards, and interoperability as cornerstones for 2024. The continued investment in real tools – including the MACH Maturity Assessment, the Admissions Playbook, and forthcoming business and technical courses launching this year – fortify the Alliance’s commitment to education and leveling up market knowledge.

While vocal demand has increased throughout 2023, the certification programs have been somewhat slow to materialize. This is likely a product of being mindful of the quality and extensibility of the course substance. The two Foundation Level programs are just the beginning, and the organization plans to scale its offerings over the coming year.

There are some compelling metrics around the rising demand for MACH in North America and how the Alliance is reinforcing this expansion with a combination of roadshows and symposiums. As I discussed with Kelley Goetsch at MACH Two last year, the addressable US market for composable is still largely untapped when compared to Europe, so it remains a primary target for growth.

Finally, the MACH Alliance continues to differentiate itself by fiercely committing to diversity and inclusion initiatives. This speaks to the culture and community it has endeavored to cultivate, earmarked by a number of milestones in 2023 – including a Manifesto for Gender Equality (signed by 40 companies) and its Women in MACH mentorship program.

Financials and 2024 outlook

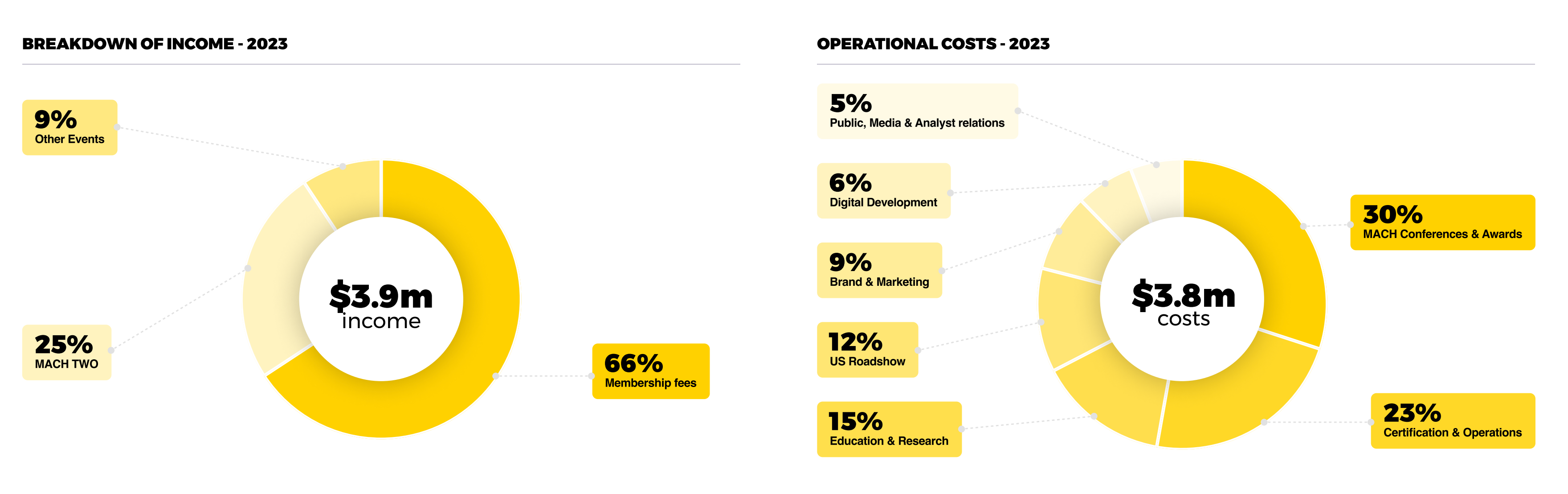

As a 501 (c)(6) nonprofit organization, the MACH Alliance is already beholden to disclose its income and expenditures to the Internal Revenue Service (IRS). This provides a modicum of transparency around operational considerations, but the annual report provides a simple snapshot of where the Alliance is deriving revenue and spending it.

Of its $3.9 million income in 2023, 66% came from membership fees. It’s worth noting that the MACH Two Conference accounted for 25% of the total, signaling its vital importance as both an educational platform and a revenue generator.

On the operations side of the ledger, the largest share of expenditures reflected conference investments, along with building a dedicated in-house team to manage certifications and other functions.

Looking ahead, the report zeroes in on the continued growth and adoption of MACH, the role of artificial intelligence as a game changer for automation, and sustained trends towards modularity. As crystallized by a Gartner quote that bookends the document, 70% of organizations will be mandated to acquire composable DXP technology by 2026 – a 20% increase from last year. This underscores the opportunities ahead.

Why it matters

Like any good annual report, the MACH Alliance’s efforts are meant to capture a year’s worth of activity in just a few pages and make the top-level insights meaningful. For many, skipping ahead to the financials might be par for the course, but there’s a lot in this report to gestate from a forward-thinking perspective.

As the US economy continues to boom (at least the stock market), there looks to be ample opportunity to grow that market – something that’s clearly stated as a Focus Area. What’s not reflected in the report’s outlook is the very real potential for softening conditions. 2023 was replete with “mood swings” that would have been surefire indicators of a recession, with quite a few jobs shed in the tech sector. With global uncertainty and a decisive US presidential election ahead, there may be headwinds facing many layers of the tech market, and across geographies. MACH may very well deliver an attractive hedge in these times, particularly if expensive, large-scale enterprise licenses become a harder sell.

What continues to impress is the fervent commitment to D&I. It's core to the organization, and as an influential body, the MACH Alliance is uniquely positioned to “walk the talk” and drive greater awareness around the importance of these tenants. As we look ahead to developing new talent pipelines across industries and market sectors – something Rasmussen talked about in our last interview of 2023 – attracting the next generation of workers will rely on these investments in human causes.

All in all, this annual report is a sign of the Alliance’s growth and maturity. It reflects the ongoing commitment to transparency and trust – and draws a clear roadmap for what’s ahead.

Footnote: In full transparency, I am quoted in the report as an industry analyst. It’s important for you to know that while I agree with the general tenants of composable and the overall mission of MACH, I strive to maintain an unbiased point of view in a market where multiple solutions can coexist, particularly as enterprises try to find footing in a rapidly changing digital world.