On Your MACH, Get Set, Grow: New Research Reveals Expanding Support, ROI for MACH

The fourth edition of the annual survey – published by the MACH Alliance – illustrates how proven ROI on MACH investments is garnering support from leadership and growing MACH adoption.

When you deconstruct the word “research,” it literally connotes that one is searching – again.

For the past three years, that’s precisely what the MACH Alliance has been doing: “re” searching its communities of influence to establish the patterns and trends that define the direction of MACH.

Each year, the group of independent tech companies advocating for open, best-of-breed technology ecosystems has published the results of a global survey it conducts, focusing on IT decision-makers and the role of MACH and composable. Over time, the trend lines have become clearer.

This week, the Alliance presented its fourth edition of the annual study, and the findings underscore two key realities:

MACH is growing – and it’s delivering a tangible ROI for companies that are adopting it.

According to the MACH Alliance, the new survey reveals a heightened level of leadership support for MACH (Microservices, API-first, Cloud native SaaS, Headless). The report states that 91% of IT decision-makers say MACH and composable technology will be instrumental to their success in the next five years – and 85% see “clear evidence” that they are achieving ROI in their MACH investments.

In the heated race to modernize and expand, brands have poured the gas on their digital investments over the last few years, due in part to the elevated force of a pandemic. Now, as the report notes, economic volatility and uncertainty have become factors – but MACH adoption continues to see stable growth despite the drag of market conditions.

"MACH technologies are critical to ensuring resilience and agility for businesses navigating swift market changes now and in the future," said Casper Rasmussen, President of the MACH Alliance. "Sustained adoption is remarkable in an economic climate that at large has put substantial IT projects on hold. The outcomes of this year's survey confirm a steady pivot towards scalable, composable systems that cater to evolving end-user requirements, and those companies are seeing tangible payoffs from their investments in MACH.”’

It's worth noting the methodology of the survey, which was completed by 551 IT decision-makers of director level and above. 37% we C-Suite executives. The sample included respondents from the U.S., U.K., Germany, and France, and represented enterprises with at least 5,000 employees.

U.S. pulls ahead of Europe in pace of adoption

At last year’s MACH Two Conference in Amsterdam, I spoke at length with members of the MACH Alliance leadership team. At the time, it was well-established that Europe was still ahead of North America in terms of MACH adoption. But even then, many saw the U.S. and its total addressable market as a sleeping giant.

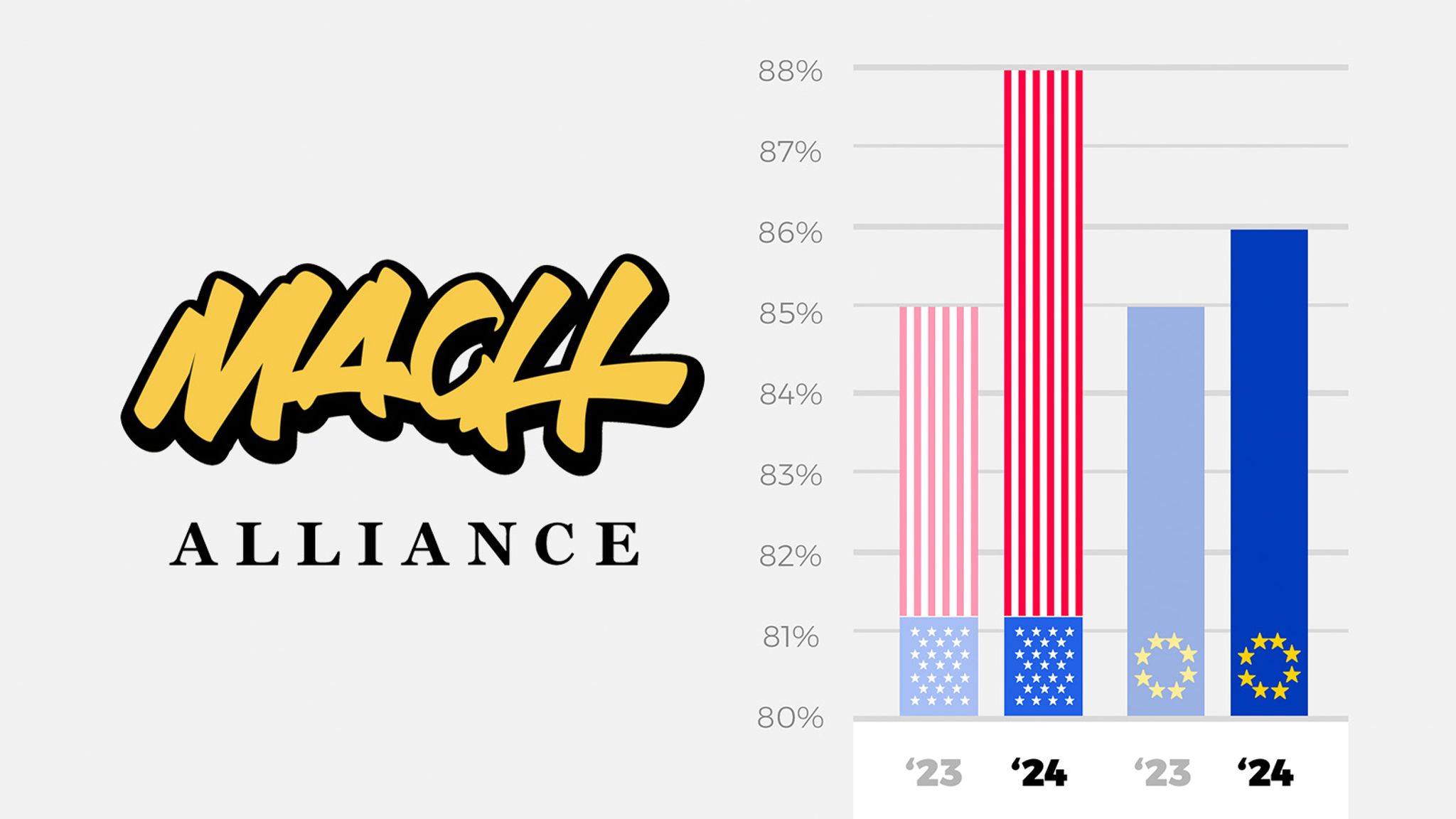

Fast forward to now, and Goliath is stirring. While the pace of MACH adoption is broadly demonstrating stable adoption, the pace in the United States has slightly surpassed that of Europe. From 2023 to 2024, respondents stated that they had increased the percentage of MACH across their IT infrastructure from 85% to 88% in the U.S., compared to 85% to 86% in Europe.

From an industry perspective, it’s clear that retail is the big winner, showing the highest investment in MACH. Retail and commerce have long been the stronghold for MACH applications, with large brands illustrating the benefits through several use cases at last year’s MACH Two Conference.

It’s worth noting that both professional and financial services categories were right behind retail in the adoption rankings, evidence that the benefits of MACH are being experienced beyond the core of retail and commerce.

Leadership leads the way to growth

As with all new technologies, consensus is key to adoption. The shift to composable has been met with varying degrees of friction given the cost and complexity for many enterprises – particularly those reliant on legacy systems with siloed data.

But that might be starting to change. According to the MACH Alliance survey, there’s been a notable reduction of internal resistance to adopting MACH architectures. Based on feedback from respondents, there’s been a sizable decline from 33% in 2023 to 26% in 2024.

Meanwhile, leadership resistance is eroding. Today, only 18% of respondents cite the lack of board or leadership support as a barrier, as compared to 28% in 2023.

What’s driving this shift? As the MACH Alliance report surmises, it could be attributed in part to the realization of sizeable ROI from MACH investments. Additionally, more IT leaders view MACH as a key differentiator and a competitive advantage for improving customer experience and innovating faster. A growing proportion also see MACH as a way to improve their competitive posture, with almost half of all respondents making this observation versus just 39% in 2023.

The survey also revealed a number of additional benefits of MACH adoption, with respondents claiming their processes have become more streamlined while increasing revenue. They also pinpointed soft benefits such as increased “volume of achievement,” customer satisfaction, and employee productivity.

Navigating the obstacles

The MACH Alliance has taken its fair share of lumps over the last few years. Market watchers have often been critical of its austere criteria for membership, and a persistent lack of transparency has drawn ire. That said, the organization has been fervently committed to responding to feedback – and has deftly managed these challenges as it continues to advocate for composable architectures and practices.

One of the biggest obstacles to MACH adoption continues to be education. This is not limited to the core fundamentals of MACH architectures but to the trade-offs between upfront costs and realizing the future benefits of a MACH investment.

According to the survey, respondents also voiced concerns about end user and customer resistance to change, as well as reliance on vendors to ensure continuous business operations. These represent key barriers to adoption.

To address these issues, the MACH Alliance is rolling out an education program in Q2 of 2024 to help companies face these challenges head-on and mitigate the risk.

Why it matters

The MACH Alliance is more than a cabal of like-minded technologies. From the beginning, it has been committed to building awareness and driving visibility for the MACH movement – and doing so by investing in education and market research.

The data in this survey helps validate the continued motion toward composable and MACH solutions. With four years of data – albeit across relatively modest samples – the trend lines are solidifying. This further reinforces what Kelly Goetsch, former president of the MACH Alliance, observed at the MACH Two Conference: “MACH now feels like the default.”

Why is this important? Because it serves as a barometer for broad change. Clearly, more businesses are paying attention, studying the potential benefits, and weighing the risks and rewards that come with the composable journey. For those already on the path, the results are paying off. This is where the numbers help tell the story.

In my year-end wrap with Casper Rasmussen, we discussed his predictions for 2024, which included the concepts of “continuous everything” and composable M&A (you can read about them here). Both are gaining visibility, but the one I’ve reflected on most as it relates to this research is the notion of MACH expanding to new industries.

In this year’s research, retail continues to have the strongest magnetic pull toward MACH. But the emergence of professional and financial services as close contenders underscores demonstrable growth in novel areas. Casper sees MACH evolving beyond retail and CPG in a big way, particularly in sectors that are not driven by commerce or transactional activities – including automotive.

Research is vital to every organization, and we can’t always do it alone. We rely on proven authorities to help augment our understanding of the patterns and trends, and we put our trust in established bodies with a clear commitment to advancing the industry as a whole.

Composable may not be the right choice for every business, but education can help leaders better understand what’s at stake and make the best decisions. Instead of resisting, we should be researching. And this is where the MACH Alliance continues to deliver value to its members – and the market.