What’s under the ‘FIG’ leaf? The naked truth about the Figma IPO and the market's appetite for tech

Keep your underwear on: Figma’s IPO share price surged 250% today. But there are real challenges hiding in plain sight. Can it maintain momentum in the continuing wake of AI?

When I wrote about that big, gnarly breakup between Adobe and Figma in December of 2023, I was bullish on the prospects of the latter up-and-coming collaborative design platform.

At the time, I observed that it was the best possible outcome for the fledgling player and cited a bevy of reasons why.

Sure, they missed out on a $20 billion payday. That hurt. But there’s a reason Adobe wanted them out of the picture. And based on the health of the company and its prospects, I predicted an inevitable IPO – and a potentially bigger take.

So here we are. The last day of July in the Lord’s Year, 2025. A scuttled acquisition and a billion “Adobebucks” later, and Figma has gone public in one of the largest VC-backed American tech IPOs since Rivian in 2021.

It came later than I thought, but it’s always a long road to public offerings.

Not to mention that whole generative AI thing that disrupted everyone’s roadmaps. In the same article, I talked about AI being a game changer for both Adobe and Figma, and that we could expect profound changes in the coming year.

That was an understatement.

For those of us in the digital experience industry, Figma has been a wunderkind. Designers have flocked to its elegant, easy-to-use suite of online tools. A crop of middleware solutions – including Framer, Siter.io, and Figment, to name a few – have streamlined consumption of Figma prototyping, allowing users to convert their low-code designs into performant code almost instantly.

Figma now has its own native gateway to shortcut that step. Figma Sites, which launched in beta this past May, promises an all-in-one tool for designing, building, and publishing responsive websites without leaving your Figma workflow.

The company also purchased Payload CMS in June, an open source headless content management system and application framework with developer centricity. It was a relatively quiet transaction that speaks volumes about Figma’s strategy, which is pretty clear at this point:

They’re building an empire.

But in the age of AI, is it too late to conquer the SaaS landscape? Does it have what it takes to really fly?

A unicorn with wings

By all accounts, Figma is pointing its magical horn in the right direction. According to Bloomberg, it posted a 46% year-over-year increase in revenue and a threefold leap in net income in Q1 of this year. With 13 million active users and 95% of the Fortune 500 as customers, it was already doing everything right before listing its shares.

Much of the kerfuffle surrounding Figma’s investment trajectory stems from the aforementioned death of the Adobe acquisition. The deal was plagued by regulatory clashes, forcing Adobe to walk away from the table and pay a hefty $1 billion termination fee.

But talk about a turnaround for CEO Dylan Field. The 33-year-old still retains 74% of the voting power at Figma, securing his place among the Silicon Valley elite. The Adobe morass has done nothing to stall the abject enthusiasm around this IPO – which stands to deliver a multi-billion-dollar payout to investors like Kleiner Perkins and Sequoia.

As I noted in 2023, the M&A landscape was precarious. Not much had changed until this year. Already, we’ve seen IPOs for Chime, Circle, CoreWeave, MNTN, and Slide – and that’s despite the drag of uncertainty around tariff policies and global conflicts.

What’s going on here? Is this a release of sorts? An unclogging of the proverbial pipeline?

Maybe. The M&A sector has been hungry for positive paydays, and Figma’s wings appear to be strong enough to fly. That said, there’s a bigger litmus test: If “FIG” shares (the company’s stock ticker) hold steady over the coming weeks, it might be a signal that planned tech IPOs are cleared for takeoff in the months ahead.

Peeking under the ‘FIG’ leaf

From every measurable perspective, this was a big day. Figma tripled its IPO price, starting at $33 and closing at $115.50 with a market value of over $69 billion. At one point, the stock price had surged by a whopping 250%.

So what are we missing? Is this just irrational exuberance? Is the value real? What’s the downside?

Tough questions. Precisely the kind that require a deeper look.

Quick sidebar: If you know anything about the notorious fig leaf in classical art, it was a visual tool for regulating morality. The leaf was applied to paintings and sculptures, obscuring the “bits” of nude male and female figures to protect citizens from the horrors of human anatomy.

The thing about a fig leaf is that it doesn’t really shield anything. It becomes a focal point. A trap for attention. And in the case of Figma, the real question is what happens next. This IPO comes at a precarious time for software companies for several reasons, and it’s worth lifting the leaf for a peek at what’s really hiding in plain sight. Here are three things that present both opportunities and challenges:

1. AI is the new battleground

AI has become the front in a fierce war for SaaS users. Figma is already in the game, offering a robust suite of AI tools designed to assist with creative tasks, from text and image generation to enhanced automation.

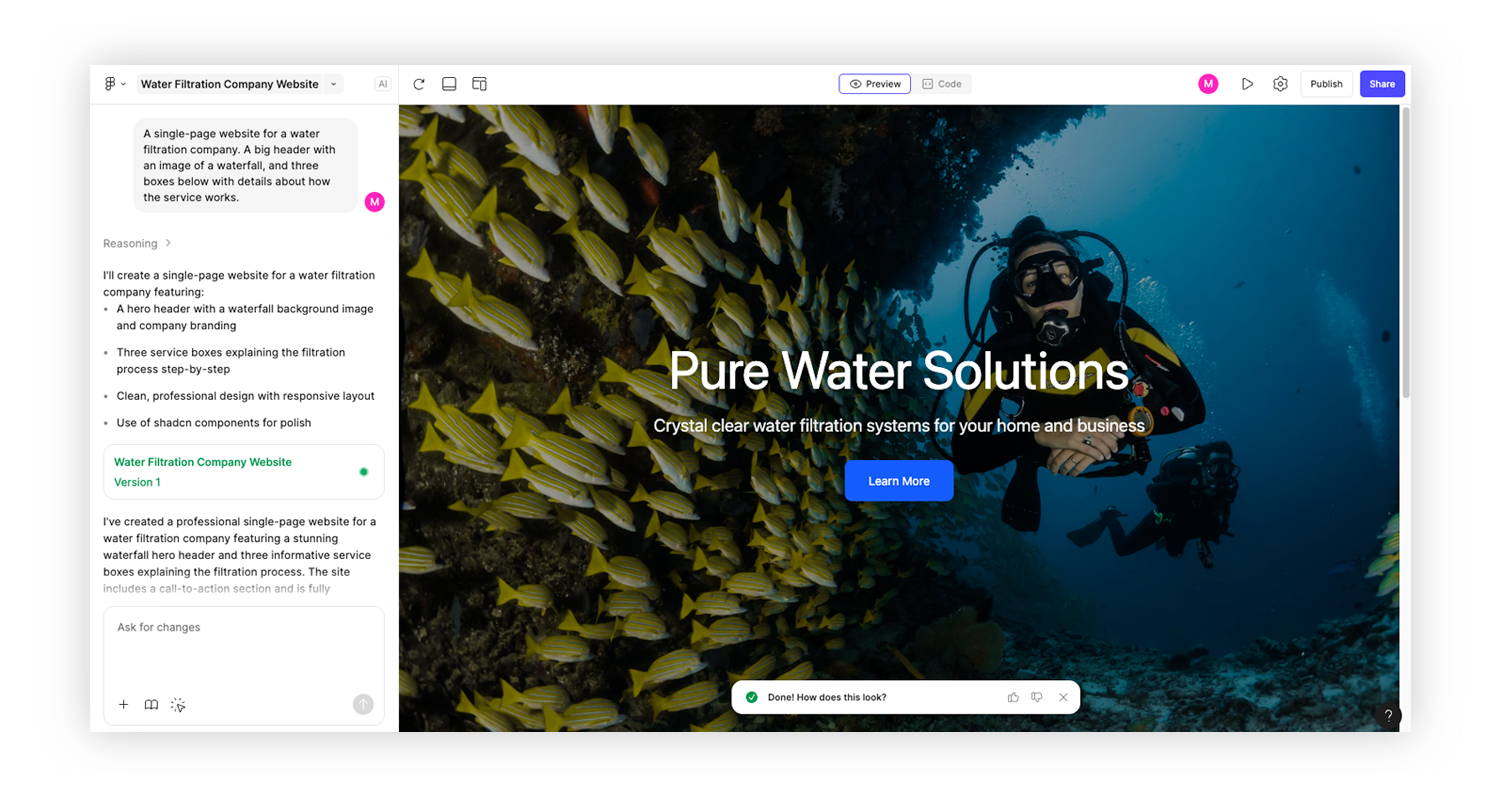

But the real magic is with its new Figma Make, a prompt-to-app feature that enables users to generate functional prototypes in seconds. The promise of instantly conjuring web apps, interactive UIs, and more – simply from a prompt window – is mindboggling. Further, to have performant code produced in tandem is borderline miraculous. It’s not perfect, but it’s astonishing to watch it compile and produce something close to perfect.

Source: Figma website

I’ve been monitoring the growth of these features for the last two years, and Figma’s flavor of bleeding-edge, AI-powered experience is transformative. Imagine the downstream impact on theme and template libraries, or raw Bootstrap development. Be ready – it’s all moving in this direction.

Like any modern software company, AI is core to Figma’s roadmap. But as Field wrote in his IPO letter, it’s still in its infancy – and while we all feel the gravitas that AI will bring to its integrated design ecosystem, he didn’t focus on the company’s AI plans or detail any specific track. He instead doubled down on more of the concrete benefits associated with the IPO, and where investors should focus.

That said, the continued investment in AI will be expensive and hard-fought. Even now, as Figma basks in the afterglow of its stellar IPO, small startups and enterprise teams are harnessing AI in similar ways. Just as we saw with DeepSeek on the model side, new tools present a clear and present danger to maintaining market share. This is where a dynamite UX, stellar service, and a commitment to trust can be intangible differentiators.

2. Adobe’s gloves are off, and competition is heating up

Unshackled by its acquisition, Adobe is leveraging its war chest of innovation, decades of amassed treasure, and a household name that few tech companies will ever achieve. And with its investment in new initiatives like AEM Edge Delivery Services, it's rapidly moving into new spaces to drive faster, more composable solutions.

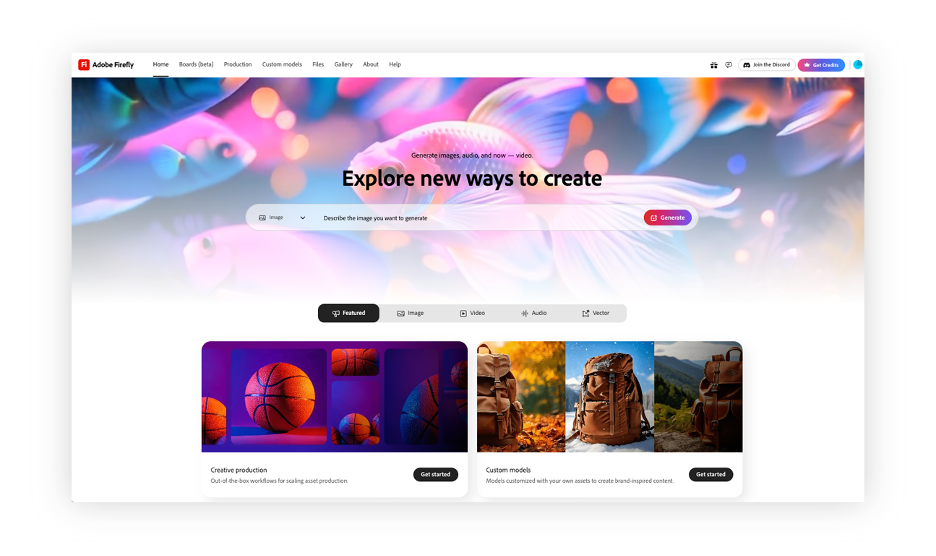

Adobe has also been adding AI to its products at a breakneck pace. They’ve already set an incredibly high bar with their Adobe Firefly suite, which enables creatives to generate images, audio, and even video with simple prompts. You can also select custom models using your own assets to generate on-brand content. Few platforms can approach the integrated tooling, which is also why it sports a heftier pricetag.

Source: Adobe website

As someone who has used Adobe’s slate of AI tools – including image generation in its ubiquitous Photoshop image editor – I can attest to both the wonder and shortcomings. The results, while sometimes breathtaking, often miss the mark. This is where designers are learning how to harness prompt engineering to realize success with these new tools.

On the prototyping front, an area where Figma has become the de facto industry standard, Adobe is also making leaps with its Adobe XD platform. The UI/UX design solution now boasts richer features and seamless integration with the broader Adobe suite of products. It still feels lackluster in comparison to Figma’s visual experience, but it’s making strides.

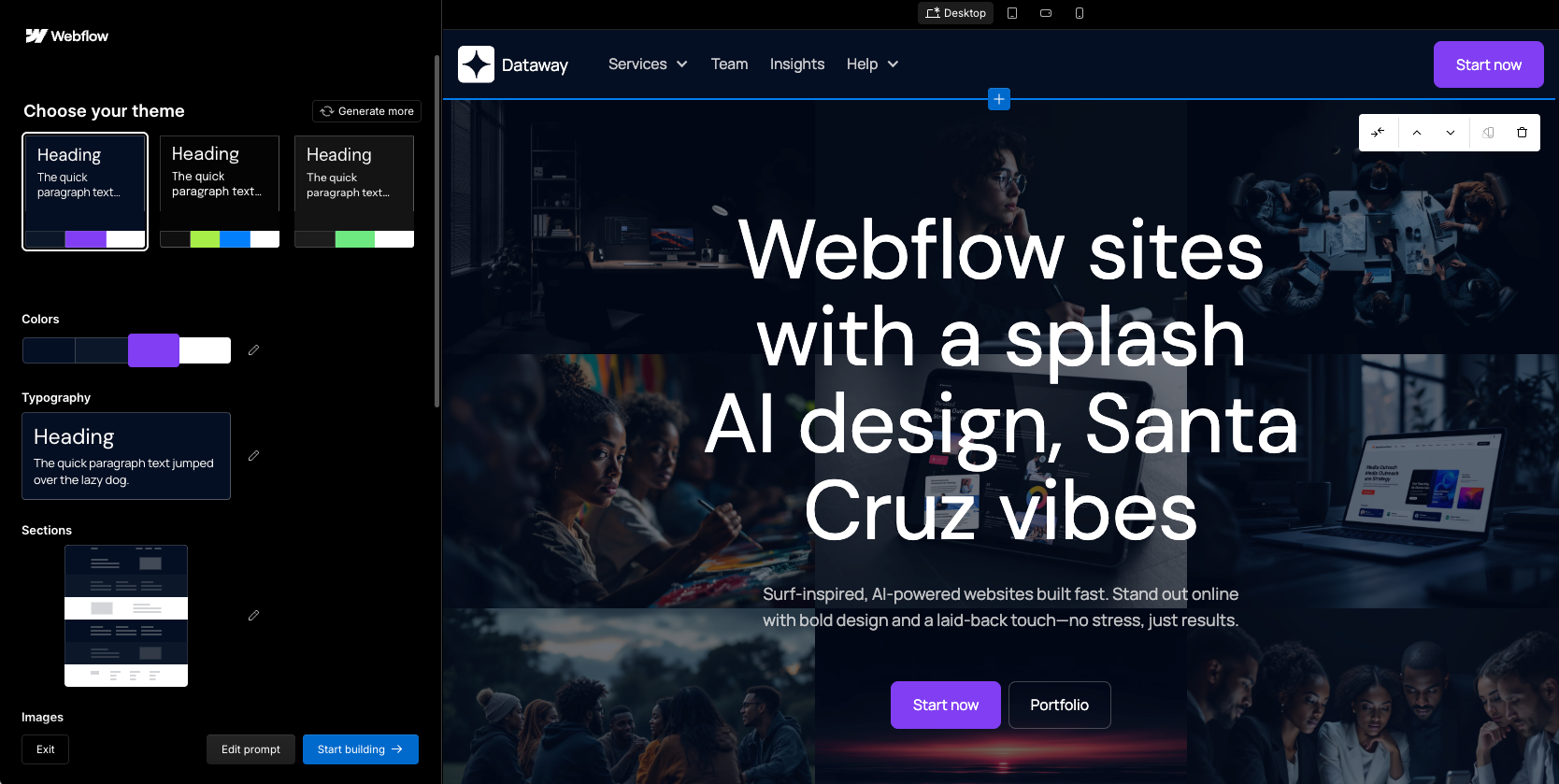

It’s not just Adobe tightening the vice grip. Contenders like Webflow are upping the digital ante, introducing their own AI site builder this year. Much like Figma and Adobe, it offers a prompt-based generative experience that produces stunning templates to build on.

Source: Webflow website

Downstream, more DIY solutions like Canva are continuing to evolve their integrated ecosystems, providing a host of creative marketing tools that make it incredibly easy to publish content in a multitude of channels. As they explore other digital venues – including web and mobile – they could become a more direct threat.

Even Squarespace and Wix, with their own AI-powered website generators, are beginning to look like they’re on similar footing. It’s becoming abundantly clear that Figma faces a tighter field of competitors, which could impact its growth efforts.

3. SaaS is evolving and pricing is under pressure

Late last year, Microsoft CEO Satya Nadella audaciously declared that “SaaS is dead.” It was controversial and hyperbolic, to be sure, but reflected the changing framework surrounding SaaS – and how the shift towards AI and cloud-native platforms is challenging the traditional model.

I don’t think SaaS is dead, but AI is certainly evolving it. For Figma, which thrives off its per-seat, per-month plans, there’s a possibility that shifting expectations could force changes to their pricing model – especially if competitors provide value-based plays that rely on consumption-based models.

It’s not hyperbole. This approach for SaaS companies is catching on, with revenue growing 22% a year compounded since 2017. For users, it provides a lower upfront cost where they only pay for what they use, making it easier to adopt new technologies and services. Adding a token-based service could be an ideal blend for customers using Figma’s AI services or leveraging APIs within its system.

According to Bain & Company, 80% of customers using consumption-based SaaS software report better alignment with the value they receive. Nearly half of software companies using it say it’s helping them acquire more customers, and two-thirds say it’s helping them increase revenue with existing customers. So while potentially disruptive, it could prove beneficial.

Figma is also swapping its independent culture of scrappiness for the riches of a publicly traded company, which will certainly create new challenges. Despite an astronomical start to its IPO journey, odds are we’ll see some downward adjustment as the exuberance fades and the realities of managing growth settle in.

That said, Field has proven resourceful in his leadership of Figma through the post-Adobe fallout. The company has performed spectacularly, and there’s reason to be optimistic. At the same time, he cogently telegraphed that Figma’s focus is on long-term growth – and risk is simply part of the game.

The naked truth

Right now, the world is Figma’s oyster. But how long before this pearl loses its luster?

Hard to say. But there are a few things working in Figma's favor.

First, a big part of the “secret sauce” for software companies is their community of users. This is especially true in the creative and development segments, where people are passionate about the products they use. Figma has cultivated its own committed cohort, numbering in the millions, led by design professionals who are deeply invested in the tool as part of their practice.

At the same time, the shift from private to public could raise concerns for its loyal users, many of whom fear the reality of boardroom-driven decisions that could impact the spirit of a software experience they know and love. With Field behind the wheel, that’s less likely. But when the stock price starts driving the machine, culture is often the first casualty.

There’s also been volatility within the broader category. Adobe is showing us mixed signals, some of it the result of market contraction, some the impact of choice and competition. Add the net effect of tariff uncertainty and other market headwinds, and you have a potential storm on the horizon.

But as Adobe deftly demonstrates, having a strong underlying business is the key to long-term success, and that’s what Figma is betting on. With the right fundamentals in place, it can afford to take some risks and still come out on top. Of course, Adobe has had decades to maneuver this; Figma doesn’t have the luxury of time in a market of expanding choices.

While all of these factors present challenges, the naked truth comes down to AI. Its impact simply cannot be understated. While the opportunities are vast, the risk of disruption from outside forces could upend even the best-laid plans. Still, the advancement of tools like Figma Make demonstrates bleeding-edge innovation that users are gravitating towards, giving Figma a clear advantage with its design-savvy audience.

There’s also the very real phenomenon of an AI-induced “SaaSpocalypse” that radically reinvents legacy pricing models and transforms the application landscape. With greater liquidity and access to capital markets, Figma’s banner IPO might be just as critical to navigating these rough spots as investing in new innovation.

It’s entirely possible that Figma is a tipping point that ignites a tech IPO bonanza, where private players like Databricks see a path forward. We’ll need a few weeks of data to validate the direction, but even if we see stable performance, I’d be cautious of the stampede. Not every bet is a winner, and not every business has what it takes to scale over the long term.

AI is critical, but we need to focus on the business fundamentals and understand both the opportunities and the challenges. That means peeking under the fig leaves – no matter how uncomfortable it might be.

Looking for guidance on Figma? Talk to an expert.

Upcoming Events

CMS Connect 25

August 5-6, 2025 – Montreal, Canada

See Agility CMS at the second annual summer edition of our signature global conference dedicated to the content management community! CMS Connect will be held again in beautiful Montreal, Canada, and feature a unique blend of masterclasses, insightful talks, interactive discussions, impactful learning sessions, and authentic networking opportunities. Join vendors, agencies, and customers from across our industry as we engage and collaborate around the future of content management – and hear from the top thought leaders at the only vendor-neutral, in-person conference exclusively focused on CMS. Space is limited for this event, so book your seats today.