Forrester DXP Wave 2023: Vendor Commentary

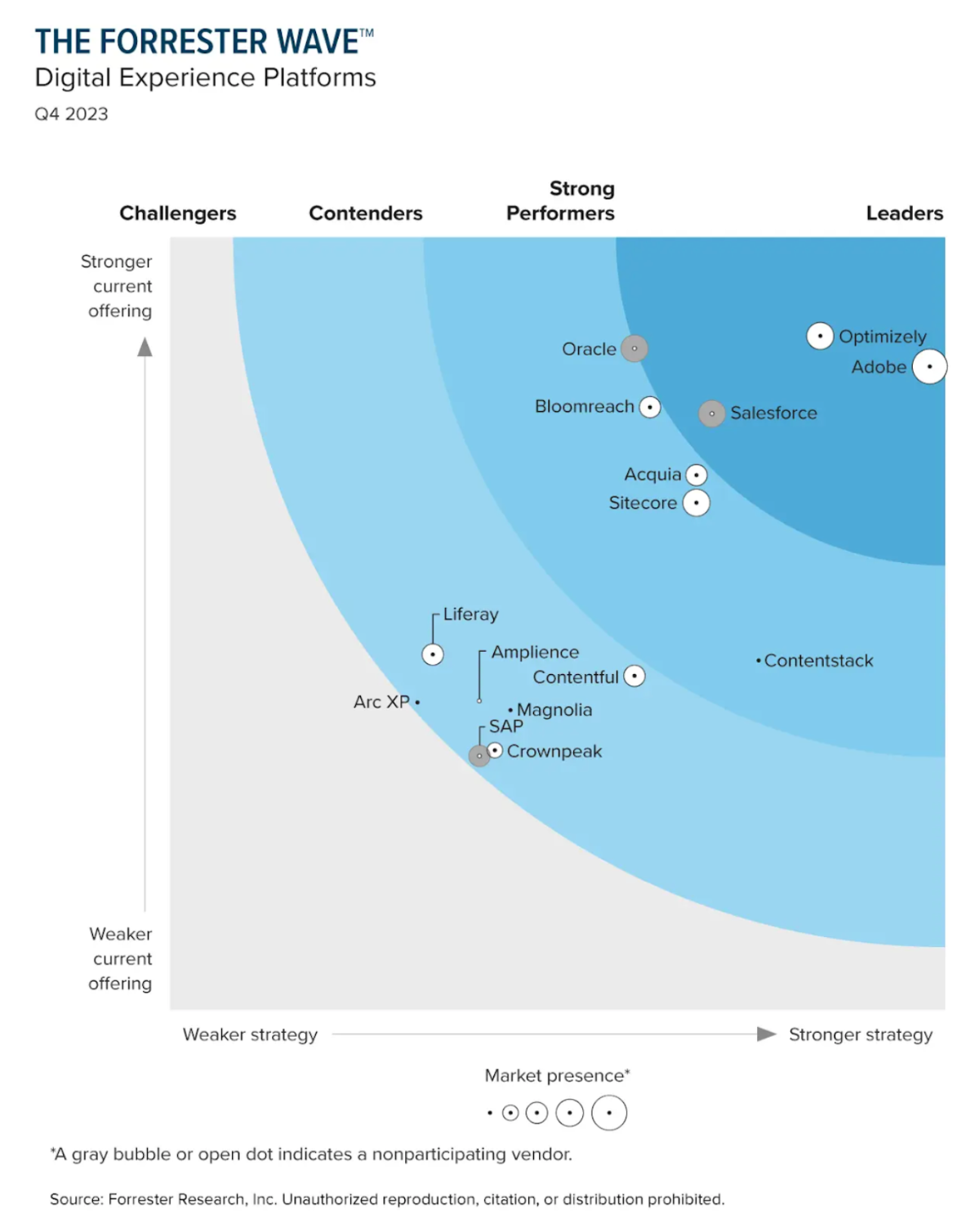

The Forrester Wave infographic can be visually challenging to absorb. This side-by-side analysis helps highlight some of the key differentiators.

This is the second article in a two-part companion set by CMS Critic contributor and industry analyst Mark Demeny.

As noted in my “meta-commentary" on the Forrester DXP Wave for 2023, there are four major vendor types lumped together in a single “Wave,” which makes it hard to pick out some of the major narratives within the report.

Rather than breaking down vendors individually, I thought it might be more useful to compare some side-by-side to pinpoint the critical differentiations – and focus on where several have made strategic choices or executed better than others.

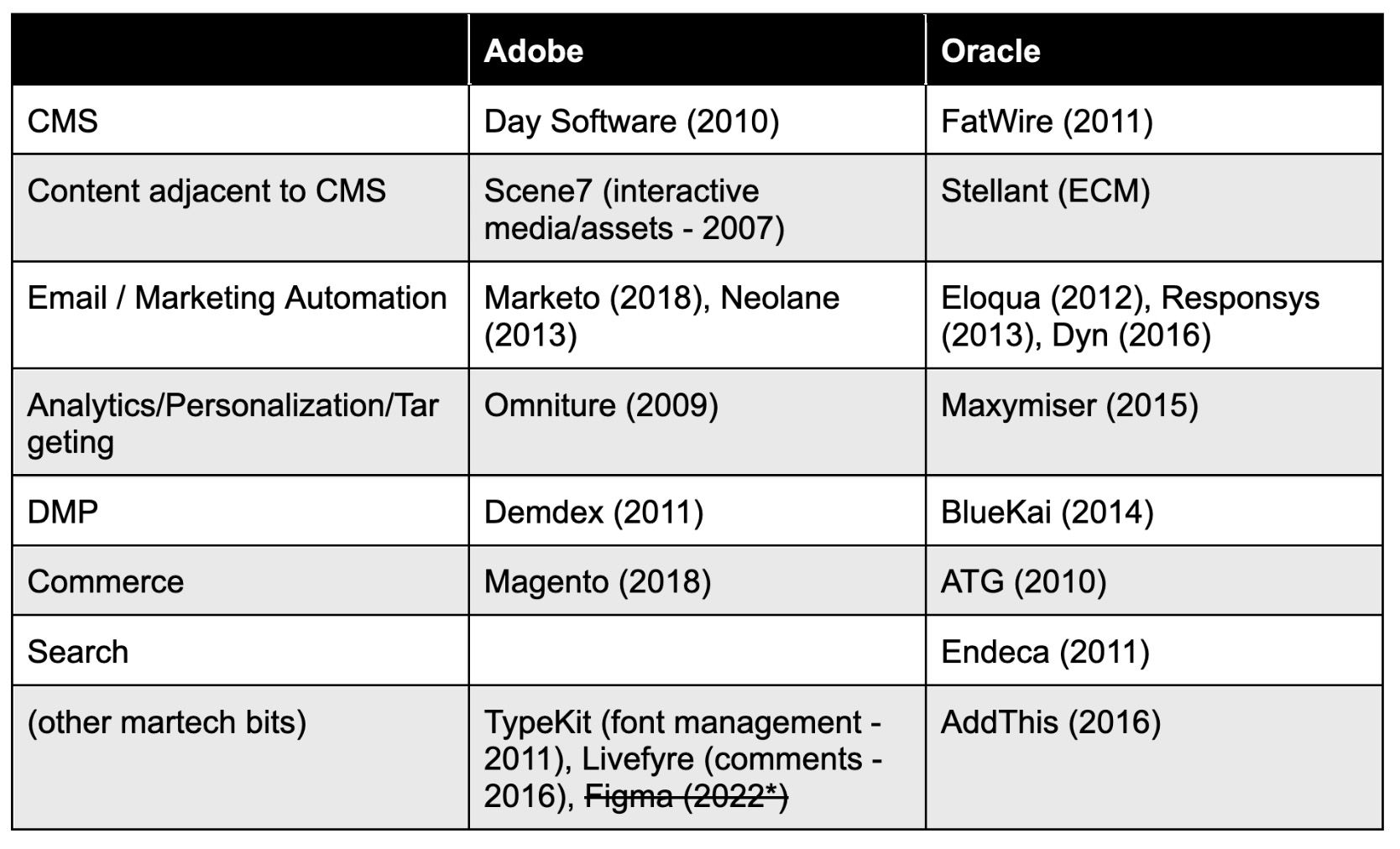

The big platform players with DXP ambitions: Adobe and Oracle

For many years, Adobe has been the 800-pound gorilla in the CMS and DXP space, leading the way in most analyst reviews (and generally assumed to be the top in revenue as well).

On paper, Adobe and Oracle have had similar trajectories, both investing heavily in marketing technology via acquisitions over the last decade or so.

Please note: This table isn’t comprehensive. If we get into a discussion of what is related to CMS, we might end up going down a very deep rabbit hole. *Figma acquisition was under review by various regulators and has since been abandoned.

However, in reality, Adobe continues to dominate the space, while Oracle has retreated significantly. It’s worth noting that only two years ago, Oracle was literally placed at the top of the pack of the DXP Wave. But in the last few years, they have all but retreated from space as they focus their corporate strategy on competing with AWS in the cloud.

According to Andy Hoar at Forrester, Oracle has “sunsetted Oracle Commerce Cloud” and also laid off a significant number of employees in their CX division. Compared to many competitors focusing on marketing technology, Oracle also leaned harder into the ad tech side of things – and various data protection laws (and a leak from BlueKai, their DMP) have meant a retreat here as well. In all, only about half the acquisitions are still actively being sold and developed, with none as market leaders.

(Shout out to Jordan Jewell at VTEX, who was able to track down those references for me.)

In contrast, Adobe has continued to invest in the DXP market – not just with their acquisitions, but continuing to retain key employees and invest further in new technologies and approaches (for example, Adobe Franklin – spearheaded by David Nuescheler, the former CTO of Day Software, now Adobe Experience Manager and the core of their DXP offering).

Similarly, Adobe has been able to successfully leverage its status within the CMO and designer community, while Oracle has completely failed to capitalize on the CIO audience.

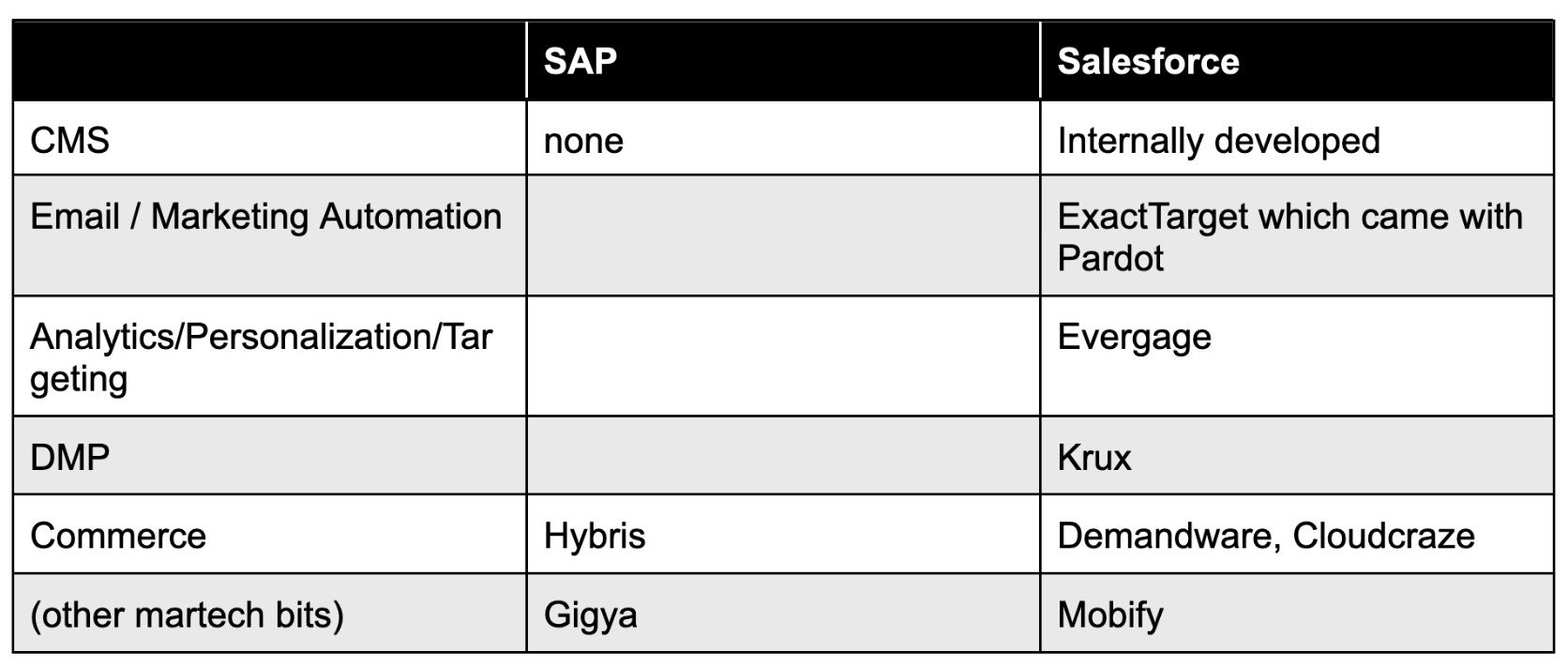

The big platform players with less clear DXP ambitions: SAP and Salesforce

SAP seemed to be ready to jump into the DXP game with the acquisition of Hybris (2013), Gigya (2017), and Qualtrics (2018) and subsequent all-in branding around SAP CX.

However, since those initial forays, SAP seemed to largely pull back from their pivot to CX. The Qualtrics acquisition may have actually been a net monetary gain for SAP, but it is clear that it did not lead to the customer experience nirvana that SAP was seeking – and it may have blunted the company's appetite for acquisitions and expanding outside its comfort zone.

In the context of this market, it is interesting to note that the SAP CX unit seemed rudderless after the departures of Bill McDermott and Alex Atzberger – unable to capitalize on this effort and seeing Hybris losing ground to the likes of Shopify and commercetools from both ends of the market.

Interestingly, Atzberger is now the CEO at Optimizely, the current top-ranked vendor after a long climb. There, he seems to hit upon a more successful strategy with those key elements (and acquisitions) being executed successfully.

Salesforce is another puzzling one. They've acquired just as much as Oracle and Adobe across the entire DXP spectrum, yet seem to be lacking an overall DXP strategy. This is due in part to the sheer number of differing architectures between the acquisitions. But it could also be that Salesforce is focusing on Commerce rather than DXP, which is often led by content use cases.

Further, the Salesforce CMS is not seen to be strong enough to compete against other players, so the company may feel it is not a strategic focus. This leads to the question: why aren't they putting more effort into this area (either in product or M&A), considering they already have so many of the key elements in place?

Like Oracle, Salesforce is no longer actively selling their DMP offerings, having retired Audience Studio – what was once the Krux acquisition.

The private equity-backed, DXP-focused platform players: Optimizely, Sitecore (and Acquia)

Like Adobe and Oracle, Optimizely and Sitecore have been on an acquisition tear as of late, but with some different fates (though not as stark as the previous set of comparisons).

The main difference between the two is how well they have executed post-acquisition. Optimizely has done a great job of telling the story of the “lifecycle of content,” and their product strategy and messaging back this up. Optimizely has looked at their Welcome Software acquisition as a cornerstone of its strategy, while Sitecore has scarcely done the same with Stylelabs (despite being potentially as transformative to the overall product strategy).

Meanwhile, Sitecore is leaning heavily into “composable” messaging (which is great), but the actual experience and integration of the products themselves are well behind where they should be at this point.

There are a few key examples where this lack of integration – even among the cloud-native applications – is evident. For example, DAM, PIM and eCommerce are common integrations. The ability to easily tie together commerce product data, images, assets, and cart elements in a well-coupled pattern is common.

And yet, Sitecore lacks this capability entirely. There is no reference in the documentation from Order Cloud to Content Hub and vice versa – though, ironically, there's still integration documentation for the legacy and obsolete XP and XC products. Similarly, the integration between Content Hub and XM Cloud also uses a method that is outdated in a SaaS era, and where competitors offer a single-click integration in comparison.

In summary, both are pursuing similar corporate strategies of advancement and “SaaS-ification” via acquisition. But Optimizely is further ahead in actually doing the heavy lifting to make sure the elements work together. (The same can be said for Adobe as well).

I would also consider Acquia to have a similar strategy around acquisition. However, Acquia additionally has what I like to characterize as a “pushmi-pullyu” problem. Let me explain:

On the one hand, there is the Drupal camp centered around open-source principles. Dries Buytaert (creator of Drupal and co-founder and CTO at Acquia) is one of the smartest and most thoughtful thinkers in the community. Drupal and the Drupal Community have a massive following, especially in groups such as government and academia, where open source is a key philosophical principle.

On the other hand, Acquia is owned by one of the most aggressive and – dare I say – “capitalist” private equity players in the market, Vista Equity Partners. Known for its VSOPs (Vista's Standard Operating Procedures), they have a reputation for efficiently applying cost-cutting and product development procedures in order to sell a business quickly. The best example of this is when they acquired Marketo for $1.8 Billion in 2016 and sold it for $4.7 Billion to Adobe only two years later.

That said, the two forces of open source (and the ability to install it yourself, on-prem, anywhere) and the capitalist restructuring and optimizing (and SaaS-preferred) approach are very much in conflict at Acquia – and it will be interesting to see how this plays out, especially as Vista looks to have some sort of exit from their business.

Of course, this is true to some extent for all three of these vendors. They are all majority-owned by private-equity players who are all looking to depart in the near-to-mid future (see EQT weighs sale of Sitecore). But the open-source origins of Drupal make this tension between corporate and product goals particularly acute at Acquia.

Contentful and Contentstack

With an earlier start in the market and more money raised (their last Series F round netted an additional $175M), Contentful had an early advantage and built various go-to-market functions (marketing, sales, partnerships) ahead of competitors. They continue to be the revenue leader in the space.

In contrast, Contentstack was always perceived as a fast follower. They lagged behind Contentful in fundraising and those go-to-market functions – and as a result, their revenue is significantly smaller, but their ambitions equal (if not surpass) their larger rival.

Fast forward to today, where Techcrunch rightfully asked the big question: “Let’s see what it can get done with $175 million more.” and the answer is “not a heck of a lot”.

A reading of the Contentful changelog reveals they have not invested in adjacent areas outside of CMS – their main product investment being Contentful Studio, which is largely undifferentiated among a headless visual builder explosion from many sources. Standalone vendors such as builder.io, Webflow, Uniform, and even the likes of platform DXP vendors such as Optimizely (announced Visual Builder) and Sitecore (XM Cloud Pages).

In contrast, Contentstack seems to have more momentum around product investment outside of CMS. They are exploring some interesting capabilities such as Automation Hub, and at the same time, expanding their cross-vendor support and implementation model.

As a result, they have moved ahead of Contentful in both strategy and current offerings – and they have a clear DXP vision. Interestingly, if you look at the Forrester CMS Wave, Contentful has a stronger current offering relative to Contentstack – and this contradiction makes sense to me as it reflects their differing strategies. Contentful continues to hone its current CMS (to the detriment of any DXP ambitions) and Contentstack investing outside its core CMS capabilities.

Arc XP and… WordPress VIP (where is it?)

I might be mistaken, but I think this may be the first time that Arc XP has appeared in a Forrester wave – certainly, they are one of the less-known players in the Wave. If you don’t know, Arc XP is the productized spin-off from the Washington Post.

In some respects, Arc XP is optimized around the Washington Post use case, but also seems optimized to simply resell Amazon Web Services – which makes sense, as Jeff Bezos owns both the Washington Post and Arc XP as personal investments. The pricing model for bandwidth in large, content-centric use cases is actually very good (if no longer as transparent as it once was), but organizations in these industries should definitely consider it.

Annoyingly, WordPress VIP is absent from the DXP Wave. Given that these two vendors compete almost exclusively around core use cases of media, publishing, and corporate communications with similar features and functions, it’s puzzling not to see these two side-by-side in the same report (WordPress VIP is in the CMS Wave only, and Arc XP is not).

Both these vendors compete in an interesting space that is largely separate from most other DXP use cases. There was a third vendor – Vox Chorus – which was also the spin-off of a publisher, but they recently decided to exit that business in favor of WordPress VIP.

Amplience, Bloomreach (and Magnolia)

These two vendors excel at providing the capabilities around commerce-centric use cases. In the case of Bloomreach, it’s the search merchandising capabilities; in the case of Amplience, it’s the asset management.

Despite both vendors being lower in the rankings, they have both carved out a niche in fitting snugly against e-commerce solutions to augment merchandisers' capabilities around content or search.

Magnolia targets this use case to a lesser extent as well, but I would consider it one of their primary use cases, whereas Amplience and Bloomreach target commerce as their main (or only) use case.

As I noted in my meta commentary: if your use case is commerce-centric, you should actually work backward. Select the commerce vendor first, and then a CMS/DXP vendor to fit alongside. You are more likely to have success here versus taking a DXP-centric view – which may skew the vendors towards larger suites with more complexity and cost. These vendors may not be “leaders,” but if your use case demands it, they should be on your shortlist.

The rest (Crownpeak and Liferay)

Note: I have chosen not to get into the details of Liferay and Crownpeak. They are vendors that tend to focus on niches to themselves and really don’t compete strongly with other vendors on this list.

Liferay tends to do well in portal/intranet scenarios, while Crownpeak has some interesting technology for regulated industries where quality management is important. If you are coming across either of these, it’s because your use-specific case demands it – otherwise, they are rarely/never on the shortlist of most RFP and SI lists.

Closing thoughts

As I noted in my companion piece, the format of the Wave infographic makes it difficult to parse out which vendors to look at. But understanding your use case and needs up front should help narrow down where to look in this large and scattered field.

Meet Mark at CMS Kickoff 2024 - January 16-17

CMS Critic is a proud partner at this second annual edition of the prestigious international Boye & Co conference, dedicated to the global CMS community. This event will bring together top-notch speakers, Boye & Co's renowned learning format, and engaging social events.

Tired of impersonal and overwhelming gatherings? Picture this event as a unique blend of masterclasses, insightful talks, interactive discussions, impactful learning sessions, and authentic networking opportunities. Prepare for an unparalleled in-person CMS conference experience that will equip you to move forward in 2024.

In addition to Mark Demeny, hear from leading voices across the industry on a wide range of topics, including:

- Andrew Kumar, GVP at Uniform

- Becky Brown, Content Strategy Lead at Johnson & Johnson

- Marli Mesibov, Content Strategy at Verily

The Don CeSar: a world-class venue

Is there a better location for a winter kickoff than Florida's beautiful, sugary sand beaches? CMS Kickoff 2024 will be held at the iconic Don CeSar, just steps from the Gulf of Mexico. Dubbed the “Pink Palace,” this majestic hotel and resort provides a stunning backdrop to the conference, along with access to the local food and culture of St. Petersburg Beach.

Get your tickets today

CMS Kickoff offers an intimate, highly focused experience. Space is limited, and only a few seats remain. Don't miss this exclusive opportunity!