The DXP Kerfuffle: Finding the Big Chords in the 2024 Gartner Magic Quadrant

Is it the same song, or are the notes a little different? A familiar cohort occupies similar positions on the board, but the continued shift towards composable and applied AI capabilities is driving a new tune.

Unbeknownst to most, the acclaimed songwriter Tom Waits – famous for his raspy, sandpaper pipes and beatnik stylings – is an adept etymologist.

Not professionally, mind you. He's said as much in an interview, despite his affectation for words and their origins. His real job is that of an enigmatic troubadour, slinging poetry about the underbelly of American society from a booze-soaked barstool.

As a seeker of strange words (an etymologist’s métier), I think Waits would appreciate me describing his art as a kerfuffle. Many of his songs are messy disturbances, hanging together just enough to throw a good punch. His music is generally beyond categorization, fusing together a mishmash of styles and influences from folk to hip-hop.

One might say the same about the DXP market and how we attempt to decode the playlist. Like Waits crooning about diamonds on his windshield, analyst reports sometimes result in a kerfuffle, leaving vendors – and evaluators – with a double dose of clarity and confusion.

Case in point: the Forrester DXP Wave 2023 that hit the streets in late December. While deeply researched and well-structured in its rationale, the addition of Contentful, Contentstack, and Amplience in the report created quite the kerfuffle amongst industry speculators. This is something Mark Demeny wrote about in his analysis of the analysis, which you can read here.

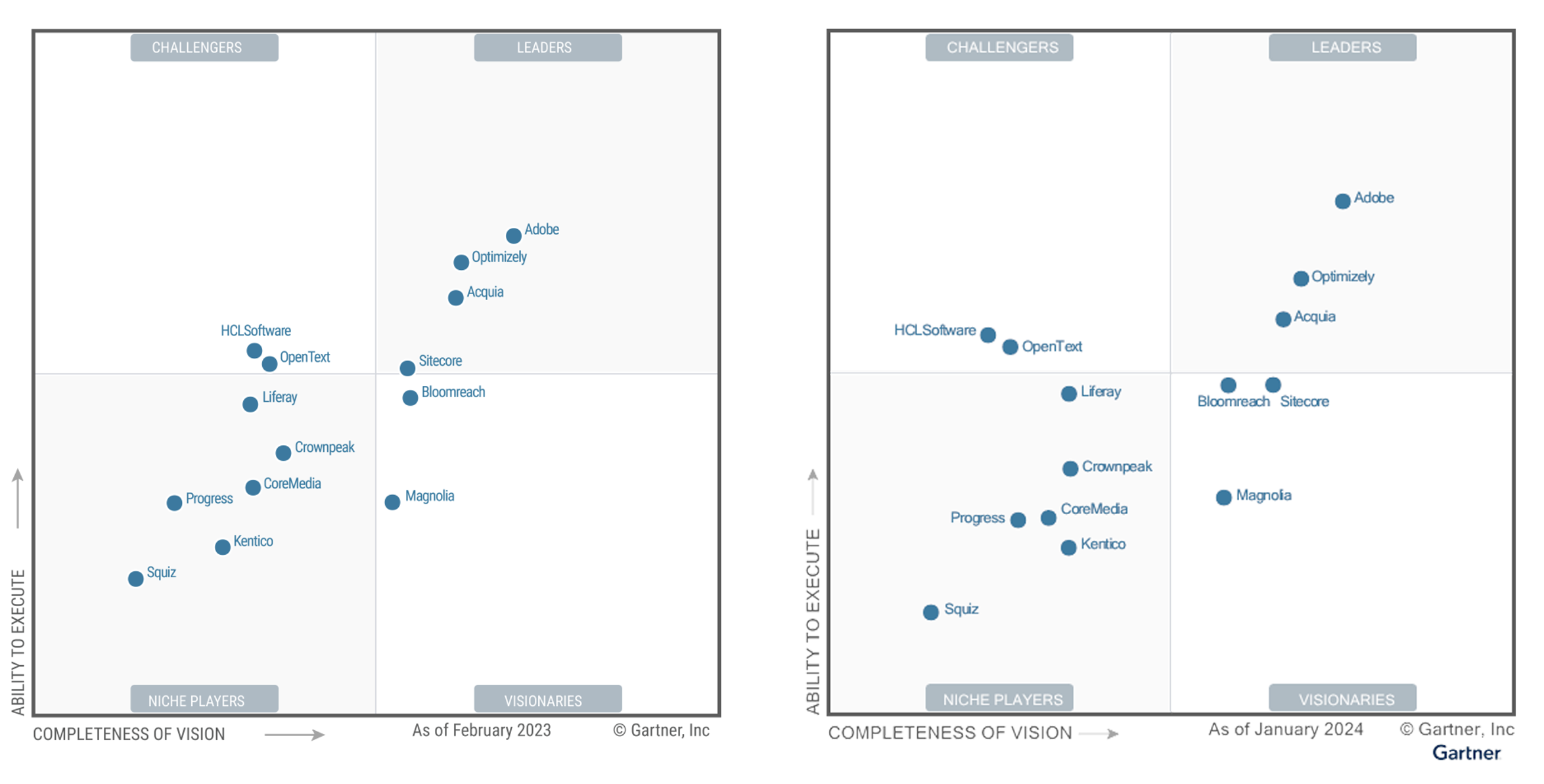

Admittedly, I expected a little more commotion from Gartner’s 2024 Magic Quadrant for Digital Experience Platforms, which was published earlier this week. Surprisingly, no vendors were added or dropped in this edition, which was penned by Irina Guseva (an immutable authority in the CMS and DXP realm).

While the platforms and positions have appreciated modest changes, the real kerfuffle is coming from a couple of key areas – and telling us a bit about what to expect in the future. One of those challenges is the very concept of the DXP category, and how a “race to the middle” is making it more difficult for buyers to understand how platforms are differentiated. And of course, there’s the notion that everything’s “composable” now. Well, sort of.

I’ll try to keep my thoughts brief (about the length of “Ol ‘55”) and share what I think is really happening on this album. Rest assured that the hits will keep coming.

What’s changed?

If you’re watching these DXP vendors with any degree of intimacy, you’ve already received a flood of marketing emails spinning the results. And there were certainly some noticeable shifts.

It’s no surprise that Adobe is leading the field, expanding the gulf between Optimizely and Acquia – the only remaining competitors in the Leaders quadrant. Sitecore, which had previously breached the line, has joined Bloomreach at the top of the Visionaries corner, where Magnolia has appreciated a decent shift in its completeness of vision.

HCL Software and OpenText continue to be the only Challengers. HCL DX, a subsidiary of HCL Tech, is a bit of an anomaly; the company offers a wide range of services, of which their DXP is only one. In this sense, it’s much like Adobe.

The rest of the action is relegated to the Niche Players – Liferay, Crownpeak, CoreMedia, Progress, Kentico, and Squiz – all making slight shifts in their general coordinates. This collection of vendors brings a unique market or industry specialization to the table or is defined by a specific geographic footprint. Regardless, they all represent a smaller piece of the pie, and generally fit better downstream with mid-market prospects.

It’s hard not to judge an analyst report by its diagram. It attempts to crystallize everything in one visual totem, which misses the nuance. Aside from the major jump with Adobe, these incremental changes don’t give a complete picture of what’s happening with each vendor.

The report itself does get more granular around the variable strengths and weaknesses, and there are certainly mitigating factors that go beyond the technology optics. In the case of Sitecore, for example, a possible sale by majority stakeholder EQT could affect perceptions for both existing customers and buyers.

Overall, I’d say that the continued alignment with Gartner’s pre-established definition of a DXP makes this diagram and report easier to digest and compare. There are no rabbits being pulled out of hats, or single use-case headless vendors joining the grid.

But therein lies the problem: how do we define – or redefine – a DXP in the composable era? As Joe Cicman of Forrester observed: “You keep using that term. I do not think it means what you think it means…”

The kerfuffle with DXPs? Becoming composable

In the Tom Waits song, “Cold Cold Ground,” a lively accordion juxtaposes morose lyrics about death. It’s a strange confluence of themes, making it sad and cheerful at the same time.

In some ways, that’s where we find ourselves with DXPs: locked in a weird dance with composability that is challenging the existing model for monoliths and shaking out new opportunities in a decoupled world.

This isn’t hyperbole. Gartner predicts that by 2026, at least 70% of organizations will be mandated to acquire composable DXP technology over monolithic suites. That figure was only 50% a year ago. Sad or cheerful? You be the judge.

In what Deane Barker of Optimizely calls the aforementioned “race to the middle,” both traditional DXP vendors and headless players have weaponized the composable mantra. Yes, as the Gartner report points out, legacy DXPs are making progress in their efforts to become more composable – albeit slowly. That hasn’t stopped them from marketing their products as “composable,” even if they’re not architecturally aligned with the spirit of the word.

Meanwhile, headless platforms like Contentstack have introduced a host of features like Launch and embraced the composable DXP mantle as a tipping point. As Gartner observes, the pervasiveness of these assembled DXP stacks is leading to the continued rise of DXC (digital experience composition) and orchestration, where companies like Uniform are providing the missing links. These technologies are also further ahead in SaaS and the advent of other modular solutions.

It’s also worth noting that several enterprise platforms are adding their own layers of visual composition and orchestration, which could have a cooling effect on downstream players.

From Gartner’s perspective, DXPs are chasing a completeness of vision that meets the market’s expectations. This includes not just CMS, but CDP, DAM, personalization, and other features that amount to a complete ecosystem play. Composable DXPs are delivering that via APIs that connect with best-of-breed solutions, like the member technologies within the MACH Alliance. This gives them a perceived edge when meeting that 70% mandate for acquiring composable over monolithic.

If the Gartner MQ tells us anything, it’s that traditional DXPs still maintain gravitas, particularly at the top of the enterprise market. Brands want reliant and performant technologies that drive innovation at scale, and this has long been the domain of players like Adobe. When brands seek out solutions that meet compliance and regulatory requirements, they’re also turning to proven platforms with long-term investments in their governance and trustworthiness.

As more companies embrace composable, the pressure for traditional players to transform their models will continue to increase. But if done properly, legacy DXPs may have the upper hand by providing greater efficiency and economies when using products from their core ecosystem. Organizations also abhor friction – and may be inclined to buy solutions from a DXP they already use. In some cases, it might be a result of loyalty; in others, the easy button.

One thing’s for sure: it’s all a kerfuffle.

AI is everywhere

While not as heavy-handed as the composable mandate, the report’s focus on applied AI solutions across the Gartner DXP cohorts is undeniable. Having covered multiple industry and vendor events last year, I had a front-row seat for many of the key announcements that centered around new AI capabilities – and the advancement of these features has clearly influenced some of this year’s positioning.

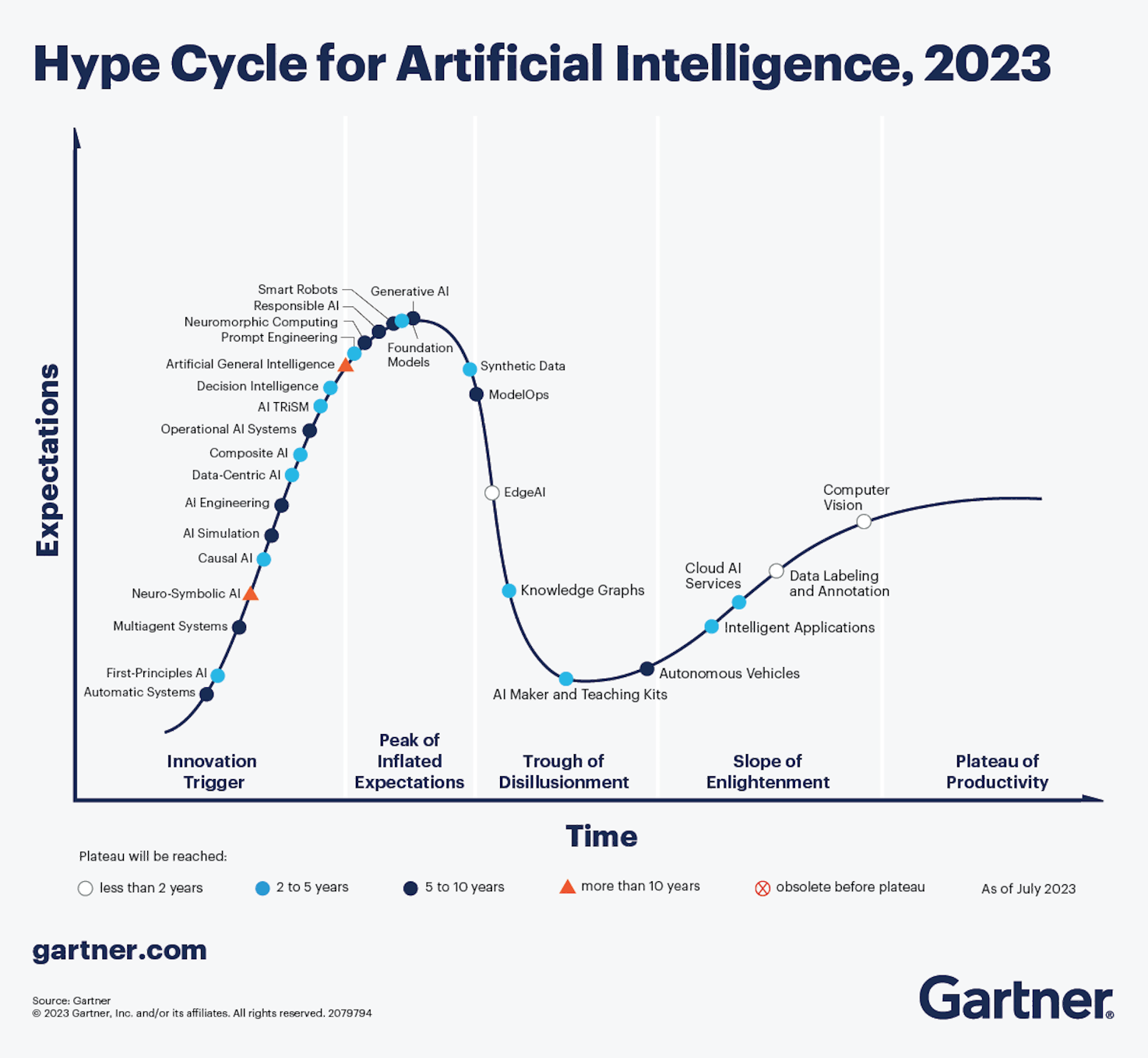

Gartner’s 2023 Hype Cycle for AI is also a useful asset when considering the impact of artificial intelligence and where DXPs are headed. In their calculus, the introduction of generative AI last year was at the “Peak of Inflated Expectations” – and precisely when many vendors started turning up the volume. Has it paid off? Are we following the track?

For some context: Optimizely’s first foray into generative imagery was introduced in January of 2023. That’s just a hair over a year ago, but might as well be a decade in the hyperbolic chamber of technology. As other platforms joined the race through Q1 and Q2, many of the same generative features became fixtures across the ranks.

Hype only gets you so far, which is what the cycle reflects. The shift from basic GPT connectors to higher-value applications came later – but it also came quickly. By summer of 2023, we saw more native solutions within CMS platforms, addressing the well-publicized OpenAI security issues and creating enhanced workflows trained on corporate data. In late spring, Acquia was promoting a community-built open-source plugin for ChatGPT. But by November, it was juicing its Widen DAM with some truly useful AI-powered enhancements.

Adobe has also been in the AI game for quite some time, and its generative capabilities are truly astonishing. While tangential to its AEM suite, just look at its GenAI tools in Photoshop and Illustrator – their most popular design tools. They’re incredibly easy to use and create huge productivity gains for users. With more free capital to spend after parting ways with Figma, we can certainly expect more innovation from the MQ leader, and that gives it a significant advantage.

Where is this all headed? Much like the race to be more composable, the thrust to remain in parity with AI innovation is essential. But we’re well past the basics, where even WYSIWYG editors like TinyMCE are incorporating generative content creation at a foundational level.

As DXPs look ahead, harnessing AI to enhance automation and accelerate processes will be a key ingredient for differentiation. We see the signs already at the top of the market, but even as Kentico and other Niche Players step up their AI game, they need to be focused on the next stage of the cycle – and unlocking greater value for customers.

Hurry up and Waits

As I said before, it’s impossible to squeeze Tom Waits into a single music category. He’s beyond any guardrails, and that makes it difficult to explain his avant-garde streak to anyone who might want a recommendation. That’s unfortunate because he’s truly one of a kind – and more people should experience his craftsmanship.

As humans, we crave the very idea of categorizing things. It’s classical conditioning, and established categories help us understand the world and ultimately make better decisions. There are still many differences across this crop of DXPs, and with so many bells and whistles to consider, we look to analyst reports as a salve – a trusted source to help make sense out of the chaos. And, in some cases, a CYA for validating a large investment in enterprise technology.

But with the kerfuffle around the defining attributes relative to composability – and the “race to the middle” creating greater homogeneity – it’s getting harder to maintain clarity.

The conflict of ideologies isn’t going to end anytime soon, and we can predict more noise ahead. With M&A expected to rebound this year, we may see additional consolidation (and even the possibility of a sale or two). SaaS stacks are getting smaller as businesses trim their expenses, and I’m personally receiving more inbound questions than ever about how to select a CMS or DXP given the number of choices in the market.

There’s also the economic realities of Europe, an impending presidential election in the U.S., and general instability across the globe. All of these factors might affect the growth trajectory of DXPs as they look to gain ground in 2024.

The Gartner MQ report also reminds me of the importance of Niche Players, and how an industry focus or a specific application can be a key differentiator. This quadrant can also be a wellspring for innovation, where riskier ideas can start small – and explode.

Given the speed of change last year, we can reasonably predict an even faster pace of innovation, thanks to both composability and AI. One of the key benefits of composable stacks has been acceleration, something proven by brand use cases featured at the MACH Two Conference last June. Add the AI sauce to that stew, and we can expect to see more products and applications getting to market faster than ever.

There's one hidden track on the record (and this most certainly has caused a kerfuffle). As my esteemed colleague and CMS Critic contributor Janus Boye pointed out, open source platforms are often un- or under-represented in the analyst mix. This has long been the case with the DXP category, and for obvious reasons: the rubric and benchmarks are geared towards commercial enterprises. Gartner is very clear about their own thresholds for participation, the least of which is revenue. One could argue that Acquia's CMS – which is an opinionated distribution of Drupal – falls somewhere on the open source spectrum, but we're back to the problem of designing the guardrails. Still, to his point, it would be good to see more representation where warranted.

As always, I recommend perusing the Gartner report to drill down into the strengths, weaknesses, and general findings. The rubric is clear, and Irina has been following this industry with a weather eye for longer than most. No doubt she can spot the kerfuffles.

OK. This ended up being a bit longer than “Ol’ 55,” but that’s what we love about this industry: the song never really ends. It might change a few chords, but the record keeps on spinning.

Upcoming conferences

CMS Connect 24

August 6-7, 2024 – Montreal, Canada

We are delighted to present our first annual summer edition of our prestigious international conference dedicated to the global content management community. Join us this August in Montreal, Canada, for a vendor-neutral conference focused on CMS. Tired of impersonal and overwhelming gatherings? Picture this event as a unique blend of masterclasses, insightful talks, interactive discussions, impactful learning sessions, and authentic networking opportunities.

CMS Kickoff 25

January 14-15, 2025 – Tampa Bay Area, Florida

Join us next January in the Tampa Bay area of Florida for the third annual CMS Kickoff – the industry's premier global event. Similar to a traditional kickoff, we reflect on recent trends and share stories from the frontlines. Additionally, we will delve into the current happenings and shed light on the future. Prepare for an unparalleled in-person CMS conference experience that will equip you to move things forward. This is an exclusive event – space is limited, so secure your tickets today.