Forrester DXP Wave 2025: Welcome to 'The Agent Hunger Games.’ Are the odds in your favor?

If it feels like agentic AI is eating everything, you’re not alone. The latest Wave report shows us just how much the agent roadmap really matters – and why we need guidance more than ever. I sat down with Mark Demeny to analyze what’s happening across the districts.

There’s a part in The Hunger Games films when the “Tributes” – that unfortunate lot culled from the districts of Panem to compete in a deranged circus of death – get to showcase their skills to a small audience of sponsors. Call it a pre-game talent review for rich despots while they tailgate to your impending doom.

Some opt to display their combat prowess. Others demonstrate their aptitude for survival. There’s even a character who can paint his skin like tree bark, allowing him to blend into the forest canopy and evade his opponents. Weird, but cool.

These days, I feel a bit like one of those sponsors, watching countless demos of agentic applications across various platforms in the digital experience space. From content workflow automation to customer journey orchestration, I’ve seen some awesome use cases and even a few jaw-dropping examples of AI magic at its best.

What I love is how marketers are the big beneficiaries. Not just developers, but less technical creators who can visually construct agentic workflows or vibe code new experiences in minutes. They can work faster. Smarter. And with more creative freedom.

In some cases, not only are these tools easy to use, but they’re even kinda fun.

But man, it’s getting noisy.

And I can’t help feeling like we’re in some kind of agent version of The Hunger Games, fighting it out to see what technologies will support AI transformation in a meaningful way. And like the movies, it’s all happening at a breakneck pace, resulting in some over-inflated expectations and spectacular failures.

AI agents are all the rage. But the market for these tools is moving past hype and into a more challenging stage of the game. The big question for 2026 is shifting from foundational model capability to application performance, with success driven by which companies deliver tangible economic results through integrated platforms – like DXPs.

Many of you have already seen the Forrester Wave: Digital Experience Platforms, Q4 2025, and there’s been ample chatter about it on LinkedIn (a place that, at times, also feels like The Hunger Games arena). While the road ahead might seem murky, it's clear that our definition of a DXP is evolving as agentic AI transforms everything.

The real question is: Are the odds in your favor?

Can you make informed choices about these products through the AI lens, when it’s all evolving so rapidly?

The short answer is yes. I’m seeing it first-hand in vendor applications, where they’re dogfooding their own technology to demonstrate and deliver. The results are real, and brands and marketers are now relying on these tools every day.

The long answer? You've got some homework to do. But maybe this analysis can help.

Like the Tributes in the arena, we need allies – and to break down this report and divine its subtext, I turned to always brilliant Mark Demeny, who knows this game better than most. He provided us with an in-depth “analysis of the analysis” back in 2023, and we chatted about what’s really happening in the subtext two years later. I also connected with several vendors at both ends of the infographic, so we could glean perspective from their vantage point.

Things are afoot in the Capitol. And while you should take any analyst report with a grain of salt, we need sound guidance now more than ever. So let’s see where things landed – and let the games begin…

Welcome to the agentic arena

If 2024 was the post-hype year for generative AI, 2025 was the full-blown explosion of its agentic era. Mark and I were both at “The Composable Conference” this past April, the MACH Alliance’s fourth annual event, which signaled its official pivot from a primarily composable narrative to the agentic frontier.

At the conference, I spoke to numerous vendors and enterprises that were touting the dawn of “agentic commerce.” MCP – Model Context Protocol – was still nascent, with a handful of use cases creating buzz. Fast forward to November, and there are thousands of MCP servers popping up across the landscape, tapping swarms of agents to perform a wide range of functions.

Without question, we’re in the throes of agentic exuberance. But it’s not all sunshine and rainbows, Katniss. Like the rampant “AI washing” we’ve witnessed, delivering value is still a bit nebulous. According to new research from Cleanlab, AI agents in production are facing constant infrastructure churn and reliability challenges – with satisfaction rates falling below 33%.

I’ve got more data coming on the unseen realities of agent performance. But suffice to say that separating the wheat from the chaff is challenging, especially as agentic features become the new measuring stick within platforms. Vendors are now facing an uphill battle as they struggle to telegraph their agentic strategy, decode the complexity, and translate it into real value.

In the latest Forrester Wave for DXPs, author Joe Cicman – who I’ve frequently channeled in the past and does yeoman’s work on these reports – builds his foundation on the precipice of “Agentic DXPs” and how they represent an evolutionary step beyond commoditized capabilities. Translation: the leading vendors in the DXP category have achieved feature parity around core functionality and are moving beyond composability to agentic capabilities.

The big change here is that these ecosystems are becoming more connected, with adjacent integrations juiced by the power of AI. Enterprises have gone full tilt, looking for ways to alleviate the challenges of managing complex stacks of disparate technologies, and agentic AI has become the glue for expanding that vision. It’s a big change, and one that will forever alter how we assess these tools.

And how will we assess them?

As Joe said, it’s all about orchestration. It’s the word I wrote at the top of the wipeboard during our final group session at the CMS Summit in Frankfurt earlier this year. But it’s not just the tools within a system for managing agents – it’s the ability for people to harness and realize their potential for enabling greater productivity and scale across their marketing operations.

The risks are real

Much like the arena in The Hunger Games, adopting AI is replete with danger. A recent study from MIT suggests that 95% of GenAI pilots fail, illustrating just how wide the “GenAI Divide” really is.

As the report suggests, companies are avoiding friction – meaning they aren’t doing the essential work needed to properly train, deploy, and manage their AI strategies. In this case, friction doesn’t lead to failure. It helps ensure success.

The same is true in this next wave of agentic DXPs. Organizations will need to embrace “agent thinking” alongside the modern agent capabilities that platforms are introducing. That will require more than just really good messaging and documentation – vendors will need to invest in human capital both internally and across their channel partnerships to activate and accelerate adoption.

The good news is that I’m already seeing this manifest at the front line. Contentstack and Sitecore – which are both included in this latest Forrester Wave – had pre-sales team members at their conferences this year, championing the interconnected nature of their latest features with real prowess. That’s what it takes.

In the case of SitecoreAI (formerly its XM Cloud offering), I spent multiple sessions with competent engineers at Symposium getting a sense of how agents could be utilized across applications. Their agency partners are already translating these benefits for customers, acting as a conduit for telegraphing this new frontier.

We’re still early in the agentic hype cycle, and this is where guidance is even more critical. That’s why analyst reports matter – as part of a balanced diet. That might be hard in a competitive arena that feels like The Hunger Games, but there are some useful data points to extract from this year’s crop of tributes.

Let’s take a closer look at what the latest Wave revealed.

Is Forrester trimming the Tributes?

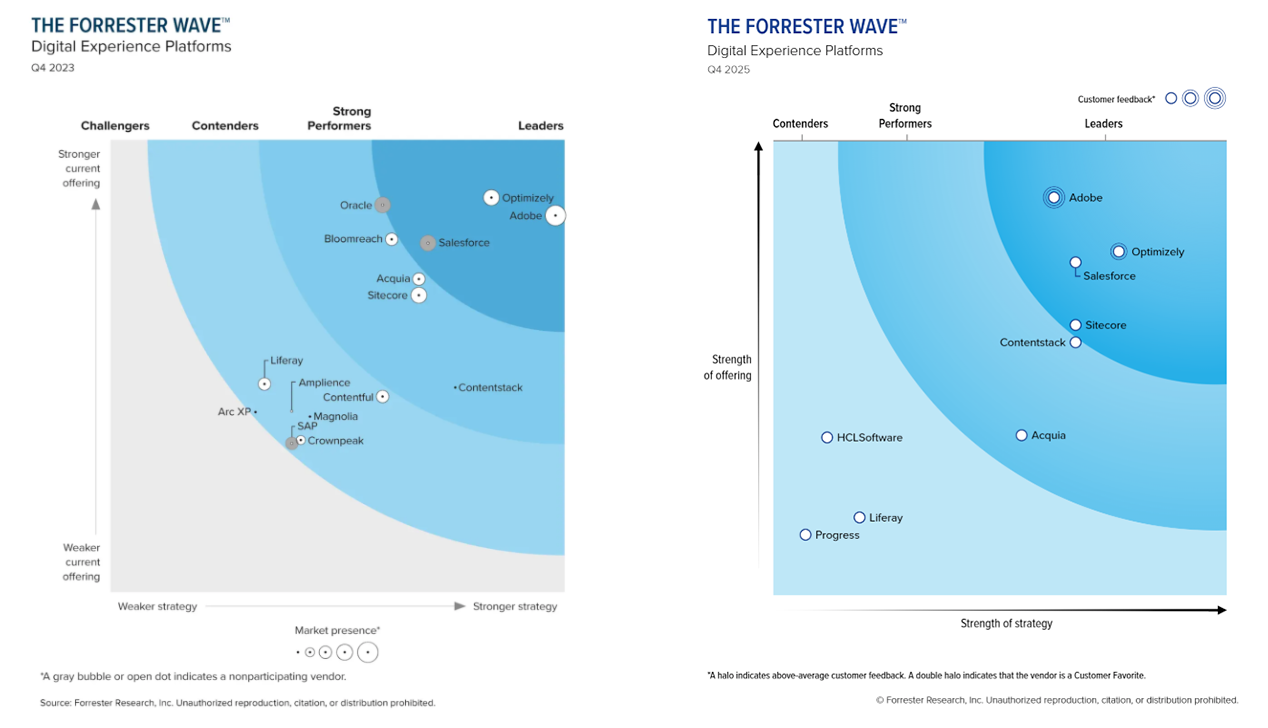

Trim indeed. This year’s Wave diagram includes just nine vendors, a stark contrast to 2023’s total of fifteen, which also accommodated non-participating players. You can read Mark’s analysis of the previous report, but here’s a quick snapshot of both diagrams for comparison:

Source: Forrester Research

Along with the shifting agentic criteria and weighting formulas, it’s worth noting the evolution of the graphic itself, moving away from the “market presence” metric and focusing instead on customer feedback, which is reflected by the concentric halos around both Adobe and Optimizely in the latest report.

Forrester has very explicit thresholds for inclusion, with a historically high bar for ARR and a clear enterprise perception within the market. This leaves a lot of vendors out of the running, including many open source platforms. The closest approximations would be Acquia (as an enterprise abstraction of Drupal) and Liferay.

Let’s talk about which vendors are noticeably absent, starting with Contentful – one of the traditionally headless players that graduated into the DXP field. Also missing are Magnolia and Crownpeak, stalwarts of the CMS and DXP categories. All raise questions surrounding their general market positions and agentic roadmaps, although both have been steadily innovating around AI.

More niche tools – Bloomreach and Amplience in commerce, Arc XP in media – are also absent, although Bloomreach is positioning itself quite loudly as an “agentic platform for personalization.” Amplience, too, is pivoting hard to an agentic narrative, elevating its “Cognitive CMS” as a foundation for powering the content supply chain.

It would seem we’re finally rid of SAP and Oracle making their way onto the map. As Mark observed back in 2023 (via Andy Hoar at Forrester), Oracle seemed to be focusing on a DXP composition, but exhibited signs of retreating. The company had shuttered its Commerce Cloud and was shrinking its CX division. SAP was doing the same, despite the merits of its Qualtrics acquisition in 2018. Neither company seemed to have a clear ambition to compete as DXPs, and their messaging and strategies reflected that.

Source: Forrester Research

As with previous Forrester Waves, 2025’s report organizes vendors across familiar entities of Leaders, Strong Performers, and Contenders. There’s quite a gulf between the left and right, which weighs the strength of the current offering with each company’s strategy and roadmap.

I asked Mark about this year’s smaller crop, and he emphasized the significance of being included among the nine vendors in the report, describing it as a "rarefied group." He noted that while there might have been more vendors in past reports, the shorter list benefits all participants. This includes Progress, which might be positioned to the far left, but is offering some real vision with its Progress Agentic RAG.

“I think if I'm Progress, I would be really happy to be there,” Mark said. “There are only nine vendors in this report, so you have to look at it that way. And I think in the past there have been significantly more vendors legitimately in the space, and there's some that, you could argue, have DXP-ish products that simply aren’t here anymore. So if you’re here at all, you can definitely turn this into a story.”

The thinning crop also reflects the spectrum of maturity among other vendors when it comes to the agentic horizon. All nine have amassed scorecards that are inclusive of their AI agent capabilities, with some much further ahead; you can see this reflected in the robustness of each vendor’s agent studio, agent orchestration framework, and personalization features.

That said, they’re all making strides – and here’s what we noticed.

Leaders: Natively AI-powered and ‘agent forward’

Optimizely

It wasn’t a shocker to see Optimizely in the pole position. Even two years ago, it was pulling ahead of its chief rival, Adobe, and assuming the DXP crown. As Mark said back in 2023, Optimizely has been executing well on its content lifecycle strategy, buoyed by its acquisition of Welcome in 2021, and its strong integration of content marketing capabilities. Welcome brought both MRM and DAM capabilities to the nest, giving Optimizely added power to complement its respected cache of testing and personalization capabilities.

The big game-changer this year has been the relaunch of its Opal AI back in July, positioning it as a standalone product that could power “infinite” use cases for marketers. At the time, CEO Alex Atzberger walked me through a demo on the fly, showing me just how this comprehensive agent orchestration platform could solve problems for marketers. The ability to harness Opal beyond the constraints of its ecosystem provides more freedom, and its bet on Google Gemini and Vertex seems to be paying off (even Mark Benioff is touting its performance over ChatGPT).

On a granular product level, Opti is also positioning itself as a “GEO-ready CMS,” which is answering the challenges enterprises face as consumers shift their search behaviors towards answer engines. At the same time, it galvanizes what agencies can accomplish with a tool that helps solve generative engine optimization while enabling them to explore the creation of custom agents for different use cases. This gives Opti and edge not just with enterprise buyers, but with partners.

I spoke to Optimizely’s SVP of Product, Kevin Li, about the latest Forrester report and why he thinks they’re setting the bar. He codified the conclusion that everyone on the map is checking similar boxes, and some are better than others in specific areas. But the real disruptor is the agentic piece and Opal’s abstracted nature.

“It's really important for us to have that standalone piece come through,” he said, describing Opal. “A lot of the other players in the space have built with an ‘AI inside’ perspective. They have AI features with AI agents, but we've actually taken a composable approach. Every vendor has AI, but who's responsible for actually orchestrating it across the tech stack? They don't just want an AI feature inside of a software that they use today. They want to transform the workflows that already sit on top of 50 or 80-plus tools, to actually turn those into agentic workflows. And Opal is in a good position to do that.”

Adobe

For its part, Adobe is pushing the outer boundaries with its agentic AI capabilities, specifically its slick Agent Orchestrator. This is all built on top of its ubiquitous and extensible Adobe Experience Manager (AEM), which includes everything from content production through journey orchestration. Its AI-powered Brand Concierge is also an illumination, providing a layer of personalized conversational discovery.

Adobe is just so big and diverse, creating both opportunities and challenges when weighing its value. It continues to be perceived as the most innovative but also the most expensive, two superlatives that enjoy a comfortable coexistence. And despite a healthy focus on R&D and a stockpile of cash, the company is in relative lockstep with its neighbors.

Still, their continued emphasis on ideation saw novel projects like Adobe Franklin become a key part of its AEM Edge Delivery, democratizing content velocity and performance via familiar tools like Microsoft Word and Google Docs (although Pantheon’s Content Publisher offers a similar experience).

Adobe’s acquisition of Semrush last week also reflects its GEO-centric ambitions, complementing its LLM Optimizer for ensuring visibility across AI engines. Like Optimizely, these are critical features for both customers and partners.

Adobe is clearly favored among large enterprises, and it has the money and motivation to continue its agentic evolution. Embracing a more composable tact over the last two years has certainly aided in that evolution, and I suspect we’ll see a steady pipeline of agentic announcements in 2026. No doubt Figma is weighing heavily on its mind as the up-and-comer introduces more Adobe-like features to its portfolio (and let’s not forget that infamous billion-dollar debacle).

Salesforce

While Salesforce might seem like a puzzling vendor in the DXP mix, it might make more sense than in previous years. Mark noted similar bewilderment two years ago, citing how it lacked a concise DXP strategy, even if it met the core criteria.

But with this year’s focus on agentic studio and orchestration features, Salesforce has renewed gusto with its unified Agentforce capabilities. It also made strides with its shift to more composable offerings, namely its headless Composable Storefront. This just further cements the evolution of what characterizes the new breed of modern DXP through Forrester’s lens.

“I am sort of curious,” Mark said. “Does this mean that DXP is undergoing a shift from its previous core of CMS, plus data, plus personalization, and other goodies on top? Or is DXP something else entirely?”

Noted. And this isn’t the first example of a DXP conundrum. Even Joe Cicman once wrote this of the acronym: “You keep using that word. I do not think it means what you think it means…”

The Princess Bride aside, Salesforce is making a strong case as an integrated platform with a robust agentic-first profile. Whether its integrations feel “solid” (that’s up for debate), or if we can really call its CMS worthy of an enterprise mantle, its agent capabilities are elevating its value in the DXP ecosystem and across the broader market. It’s also a familiar and trusted brand, something enterprises are weighing as they place their bets in the agent race.

Sitecore

Sitecore is energized – and running at full throttle on its agentic roadmap. The rollout of its SitecoreAI platform (the evolution of its popular XM Cloud) unified its ecosystem of products in a single SaaS-native solution, including CMS, DAM, MRM, CMP, CDP & Personalize, and Search.

The centerpiece of SitecoreAI is its new Agentic Studio, offering a slate of pre-built agents for automating complex workflows. Simultaneously, its new SitecoreAI Pathway also introduced an “easier button” for migration, helping new and legacy customers make the leap to the cloud, which has been a persistent source of friction.

As I mentioned, I spent quite a bit of time with SitecoreAI during Symposium a few weeks ago, getting a sense of its features and, ultimately, its ambitions. The company’s broader vision, which it calls Sitecore Studio, builds on Agentic Studio’s steam with customizable SaaS, which could be a decisive advantage. Along with Sitecore’s App Studio, Marketplace, and Connect services, enterprises and partners have much more choice and control when it comes to building experiences powered by agentic workflows.

Sitecore has long invested at the edge of AI/ML, going back to its Sitecore Cortex processing engine, and most recently with last year’s introduction of Sitecore Stream. This steady commitment was propelled by its collaboration with Microsoft to deploy an AI Innovation Lab.

As CEO Eric Stine told me, Sitecore’s shift to a more composable posture and unifying the right mix of components in a SaaS environment has fully activated its agentic ambitions.

“We’re the only company out there delivering not just a proven AI embedded SaaS platform, but one that is fully customizable,” he said. “It's the ability to build your own agents, to create your own custom use cases and flows across your Microsoft investment, your Salesforce investment, whatever you're leaning into.”

That flexibility has been augmented by Sitecore’s push to bring greater transparency and simplified pricing to fruition. This is an area where Sitecore has struggled but is clearly getting the message and leaning into stronger customer experience support. As they proclaimed at Symposium: no addons, no upsells, no tokens, no games. Now, it has to live up to that mantra.

One of Sitecore’s biggest advantages continues to be its global community, which represents over 20,000 members, 500 parters, and 250 MVPs. They have the people power, and that gives them an edge to build with.

Strong Performers: Building agentic momentum

Contentstack

Contentstack came out of the gates in 2025 with a throat-clearing moment. The headless-CMS-turned-composable-DXP made its first official acquisition of Lytics – a customer data platform – at the beginning of January, giving it the essential data layer it needed to complete its vision of becoming an “adaptive DXP,” with a clear focus on context as a strategic imperative.

As Mark noted in his previous analysis of the Forrester Wave, Contentstack had been doubling down on its DXP aspirations years ago, adding its Automation Hub and Launch for frontend hosting, bringing a more cohesive ecosystem to bear. As Mark also observed in 2023, they were lagging behind key rival Contentful in several metrics, but have clearly gained ground.

The big “aha” moment at this year’s ContentCon25 in June was Contentstack’s new Data & Insights suite. Powered by the Lytics CDP, it offered some impressive capabilities with its Audience Insights visualization, Opportunity Explorer, and Flows – which enable users to design and automate adaptive customer journeys across various endpoints.

At ContentCon, CEO Neha Sampat told me to “stay tuned” for more on the agentic front, and she made good on that in September with the launch of Agent OS, the key to unlocking what she called “context management.” Agent OS provides a convergence of data, content, and brand intelligence that delivers customer-driven experiences at scale, powered by its Contentstack Edge platform.

“Context is the most important currency in business,” Neha said. “For decades, marketers have relied on segments, rules, and best guesses to engage customers. Agent OS in the Contentstack Edge platform changes that forever.”

Contentstack leans more heavily on its partner integrations to enable its completeness, which, according to the company, aligns with its core belief that “no one transforms alone.” The company’s fervent “Care Without Compromise” program, which I’ve written about extensively, is part of its commitment to customer success and its keen focus on change management.

Compared to its peers in the Leaders ring, Contentstack might be at a disadvantage from a awareness perspective, but they’re consistently the disruptors, and are showing up in more large-scale RFPs. They also have one of the strongest visions, and that can put a lot of wind in your sails.

Acquia

Acquia might be in the oddest spot, and Mark and I agreed on this. As one of the leading DXPs in the game, Acquia has seemingly lost ground to its peers, despite aggressively innovating with GenAI in the first wave. While covering the Boston stop for its Engage conference, I saw early on how it was equipping its AI-enriched DAM for some compelling use cases.

With access to its vast open source Drupal community, a lot of great ideating was coming from ambitious developers, and that offered some elemental wins in the form of LLM plugins and connectors. That evolved into its AI-juiced Acquia Source CMS, powered by its solid Drupal heritage. The platform’s AI customization brings some solid features but still requires what it deems as “junior development resources.”

Drupal is at the heart of Acquia, and that’s a unique advantage in this pantheon. Back in July, industry luminary Dries Buytaert, founder of Drupal and CTO/CSO at Acquia, wrote a great blog about AI and the importance of strategy, orchestration, and measurable outcomes – all tenets he and his community have been focused on with the release of Drupal AI 1.1.0. This includes the new Agentic Framework and Drupal Canvas, an AI-powered site builder that allows AI to automate page creation while keeping humans in the loop.

Outside of its strong footprint in highly governed industries (think healthcare and finance), Acquia’s “open sourceness” and access to Drupal are some of its most compelling assets.

But as I discussed with Mark, it's also a double-edged sword: Being tied to Drupal brings the community, but it also creates resistance to SaaS innovation across its CDP, Content Hub, and other parts of its portfolio.

“I think they've always had that problem that if they build stuff that's SaaS, and they're charging for it, the community sometimes perceives it's taking away from Drupal resources and weakening their commitment to open source.”

While it might be facing an uphill battle when balancing its open source roots with the next wave of agentic innovation, I asked Mark what he thought of their relative position – and if they can make up ground.

“I think they can absolutely catch up. They've got the engineering chops, leadership, and vision that are capable of understanding the challenge.”

Contenders: Challenging the stalwarts with agentic promise

HCLSoftware and Liferay

We’ll tackle these together, as they typically fall outside the products we see and cover, but they do show up periodically around specific market or industry use cases.

With HCLSoftware, which boasts over 70 products under its umbrella – everything from Commerce to DevOps – there’s some promising AI under the hood with its XDO Blueprint (Experience, Data, Operations), which includes its HCL AI-infused Packaged Business Capabilities and Xperience Orchestration. It features “Agents of Action” that enable contextual automation, smart workflows, and informed decisions.

HCLSoftware’s framing of its agentic capabilities might not be as complete or elegant as its competitors – specifically around brand-aware content creation and controls – but the company is focusing on the right vector relative to free and open agentic systems and moving beyond proprietary agent limitations. That could be an advantage for enterprises.

I’ve followed Liferay for years, and it offers a fantastic open source DXP that lends itself to traditional marketing and commerce sites, but also intranets, portals, and other tactical experience applications. They have a really complete picture, from DAM to commerce to personalization, and they also package their capabilities as a content marketing platform.

Liferay’s AI-powered content generation and broad orchestration capabilities are there, but they’re buoyed by a clear focus on delivering AI responsibly, aiming to be a low-risk solution with an ISO standard. I like how visible that commitment is. Forrester scores their agent capabilities as relatively weaker (as well as some of their other core features), but it’s still a great solution.

Progress

While at the far left, it’s great to see Progress on this Wave. The company has been in the market for 40 years, and like Salesforce and HCL, offers more than just its digital experience suite and Progress Sitefinity CMS – it also sports tools for infrastructure management ops, DevOps (through the Chef acquisition), UI/UX, secure file transfer, and more. Along the way, the company has been mixing AI into the recipe, although less so during the most recent GenAI explosion.

But the track is changing. In June of this year, Progress acquired Nuclia, a Spanish startup, and quickly integrated its agentic RAG-as-a-Service into its data platform. Now dubbed Progress Agentic RAG, it’s providing a standalone SaaS solution that transforms unstructured data sources (docs, files, etc.) into business intelligence – and accelerates AI readiness. This was a great move.

In Forrester’s scoring, Progress is behind its peers across a range of criteria. But that’s not the big story. When I spoke to Sara Faatz, the company’s Senior Director of Community Awareness, she expressed how Progress's inclusion in the report validated their top-down focus on AI, and how it’s igniting a startup mentality within a billion-dollar company. She also shared how Progress Agentic RAG is enabling it to deliver the next wave of innovative products and features.

“It's allowing us to build a Generative CMS,” she said, describing the forthcoming combo of its RAG engine with its legacy Sitefinity product. “As an end user, people want their experiences to be more conversational. They want them to be adaptive. We've been talking about personalization for how many years? And personalization isn't just my name on an email, right? With RAG technology and a RAG engine, we can absolutely start to show real ways to achieve hyper-personalization.”

There’s clearly a lot of work to do. But I like Progress. And with this kind of vision and internal focus, they might be making progress towards the top.

The odds are in your favor – if you keep fighting

AI is moving too fast. We all feel it. And while it’s supposed to reduce the cognitive overload and minimize those “swivel chair” moments, it’s also creating a whole lot of anxiety.

So where can we turn for guidance on the tools we choose?

Well, analyst reports are one place, even if they feel like a mixed bag. We will agree and disagree on certain things, and that’s healthy. I’d argue that it’s part of the charter to ruffle a few feathers and challenge our beliefs.

If one thing is abundantly clear in this Forrester Wave, it’s that the DXP looks different than it did a year or two ago. Odds are, it won’t look the same in another year. That’s how profound the impact of AI is – and it’s making the planning, categorization, and eventual buying of these products even more difficult.

Echoing that sentiment, Mark pointed out how transitory things really are, and that Forrester is placing wagers on AI (just like the rest of us). Clearly, this Wave rewards those vendors with the strongest agentic vision and roadmap for content creation and delivery. But as Mark said, the rankings might change at a rate faster and greater than we've seen in the past.

“There's a good chance that some product bets may turn out to be false paths, or, similarly, an overlooked technology or vendor may drastically change some outcomes,” he said. “For example, Optimizely acquiring a vendor on few people's radar screens in the vastly underestimated CMP category has significantly changed their trajectory.”

We don't have crystal balls, but real guidance is the next best thing. Buyers need real clarity from vendors, not just demos and promises. This new crop of agentic capabilities falls outside the guardrails of what we’ve traditionally assessed, so focus on the partners with forward-thinking sales engineers who can assess your goals and roadmap your use cases.

Trust is still the most important product you’re buying, so cultivate that.

Also, consult your agency partners. Some vendors have been investing deeply in education across their channels, and agencies are at the front line of translating these benefits for a wide range of specialized use cases. In fact, David San Filippo, the SVP of Digital Content and Experience at Altudo, recently penned his own views on agentic AI and DXP readiness for CMS Critic.

On the vendor side, pricing transparency and flexibility are some of my biggest beefs. This is one area where Optimizely is setting a high bar, although its competitors are feeling the heat to improve this – and platforms like Sitecore seem to be listening and pivoting.

Once again, it would be great to see more true open source in the mix, but this shift toward agent studio and agentic orchestration is changing the formula. Many of these capabilities are becoming accessible to downstream platforms, namely MCP. Expect more noise – and potential choice – over the coming year. And keep an eye on open source.

Finally, Mark and I talked about the other “O” word: observability. With so many agents being orchestrated to do our bidding, there’s a potential to lose control. As enterprises scale up these agentic armies, vendors will need to provide more insight into their services and expanding workflows.

Battling through this transformative period might feel like “The Agent Hunger Games.” There’s a need to move quickly, but slowing your roll and making thoughtful decisions is the right course. Go beyond the technology and embrace “agent thinking.” Build strong alliances, and remember that friction can be your friend.

Stay in the game. Keep learning. And keep fighting.

Upcoming Events

CMS Kickoff 2026

January 13-14, 2026 – St. Petersburg, FL

Meet industry leaders at our fourth annual CMS Kickoff – the industry's premier global CMS event. Similar to a traditional kickoff, we reflect on recent trends and share stories from the frontlines. Additionally, we will delve into the current happenings and shed light on the future. Prepare for an unparalleled in-person CMS conference experience that will equip you to move things forward. This is an exclusive event – space is limited, so secure your tickets today.